-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

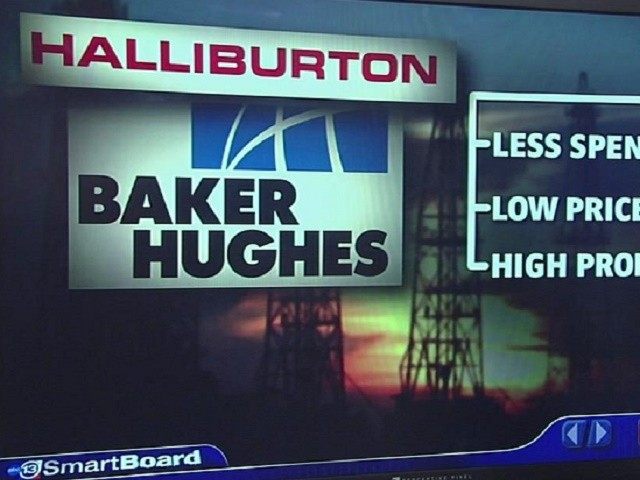

Federal suit to stop deal between 2 oilfield services firms

“The proposed deal between Halliburton and Baker Hughes would eliminate vital competition, skew energy markets and harm American consumers”, said federal Attorney General Loretta Lynch.

Advertisement

High-profile mergers have attracted intense scrutiny from the Obama administration.

The proposed transaction was valued at $35 billion and would combine the world’s two of the top three leading providers of oil services.

Melanie Kania, a spokeswoman at Baker Hughes, declined to comment.

But increasingly, skeptics have questioned whether it could pass regulatory muster. Regulators in Australia have also expressed concerns.

Low oil prices have led oil and gas companies to seek price concessions from the services companies, which in turn have cut jobs. “I don’t know how they can fight this”. The complaint also points to ValueAct’s suggestion to change Halliburton’s executive compensation plan in July 2015, its efforts to help restructure the merger and discussions about selling parts of Baker Hughes should the deal fall through.

U.S. Department of Justice headquarters.

Both companies strongly believe that the proposed divestiture package, which was significantly enhanced, is more than sufficient to address the DOJ’s specific competitive concerns. U.S. District Judge Emmet G. Sullivan is expected to rule next month. In order to fetch regulatory approval, Halliburton had planned to divest assets worth $7.5 billion, which is not enough according to the DOJ.

Some antitrust experts predicted the deal would raise red flags.

“That gives them confidence and emboldens them in the way they think about transactions”, said Jeff Jaeckel, a Washington lawyer who has represented airlines and other companies in antitrust cases. But antitrust regulators are concerned about too much market power.

“Baker’s better off taking that money, doing a levered buyback and fixing their business and being a real competitor, instead of sitting around, constrained by the merger agreement”, Uhlmer said.

“When the deal was first conceived, they didn’t have that landscape of challenged deals before them to consider”, said Ms. Schaeffer.

Shareholders of Baker Hughes and Halliburton had voiced support for the merger, essentially a defensive move in response to clients slashing their exploration and production budgets because of tumbling oil prices.

Advertisement

The takeover, which would unite the No. 2 and No. 3 oil- services firms behind Schlumberger Ltd., faced early resistance from USA officials, people familiar with the matter have told Bloomberg News.