-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Ford Motor Company, (NYSE:F), Chesapeake Energy Corporation, (NYSE:CHK), General Electric

The company traded a volume of 35.26 million shares as comparison to average volume of 34.92 million shares. EPS ratio considered by looking at last twelve month figures is 2.25. Stock’s minimum price target estimates has been figured out at $28.00 while the maximum price target forecast is established at $38.00, if we look at the price target with an optimistic approach it has upside potential of 28% from its latest closing price of $29.75. JCP market capitalization is $3.02B with 105000 employees. The company’s institutional ownership is monitored at 58.7%. Company gross margin stands at 22.40% whereas its return on investment (ROI) is 13.40%.

Advertisement

A number of FactSet analysts shared their views about the current stock momentum.

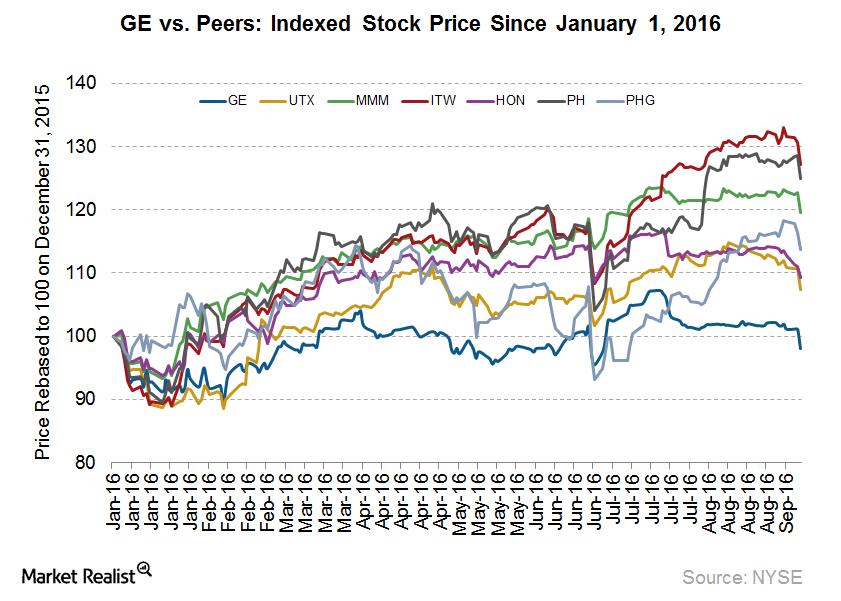

07/12/2016 – Portland General Electric Company had its “buy” rating reiterated by analysts at UBS. General Electric Company (NYSE:GE) has risen 8.38% since February 11, 2016 and is uptrending.

12/10/2014 – Portland General Electric Company had its ” rating reiterated by analysts at Macquarie. The stock traded total quantity of 51.08 million shares. The trading began at US$29.81 but the price moved to US$29.67 at one point during the session and finally capitulating to a session high of US$30. During the 52 -week period, the stock’s price traded between range of $24.26 to $33.00. The last stock price close is down 3.53% from the 200-day moving average, compared to the Standard & Poor’s 500 Index which has fallen -0.01% over the same time period.

Earnings Surprise: According to the earnings report released for Quarter Ending Jun-16, The Company posted actual earnings of $0.51 per share whereas the Analysts projected earnings were $0.46 per share. The ratio worsened, as 70 funds sold all GE shares owned while 836 reduced positions. The institutional investor held 1.68 million shares of the consumer electronics and appliances company at the end of 2016Q2, valued at $53.25M, down from 1.78 million at the end of the previous reported quarter. Credit Suisse has “Outperform” rating and $34 price target.

Receive Portland General Electric Company News & Ratings Via Email – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Portland General Electric Company with MarketBeat.com’s FREE daily email newsletter. The stock is a Buy among 9 brokerage firms polled by Factset Research.

Advertisement

03/04/2016 – Portland General Electric Company had its “hold” rating reiterated by analysts at Wellington Shields. The undervalued equity displays PEG ratio of 0 or 1. Recently, investment analysts covering the stock have updated the mean rating to 3.2.