-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Gold Rises Ahead of the FOMC

What will be closely watched is the Fed’s language in the statement and Fed Chair Janet Yellen’s press conference right after the meeting that could provide clues on the pace of future interest rate increases. On Tuesday, US Dollar fell to a seven-week low against a number of currencies which increased the expectation of an increment in the interest rate. This has been the lowest since December 3rd and of course we are talking about on the Comex division of the New York Mercantile Exchange.

Advertisement

On Wednesday on the Comex market in NY, gold futures with February delivery dates rallied from near six-year lows after the US Federal Reserve lifted interest rates for the first time in nine years. While liftoff on December 16 is widely priced in, gold will still retreat over the coming year as rates continue to rise, according to Societe Generale SA. The Fed funds futures, which is how investors bet on the decision regarding monetary policy, is showing a 79 percent chance of an interest rate hike. Some people are saying that Wednesday is going to be a insane day with a lot of casino-type of betting and gambling going on, at least for short-term investments.

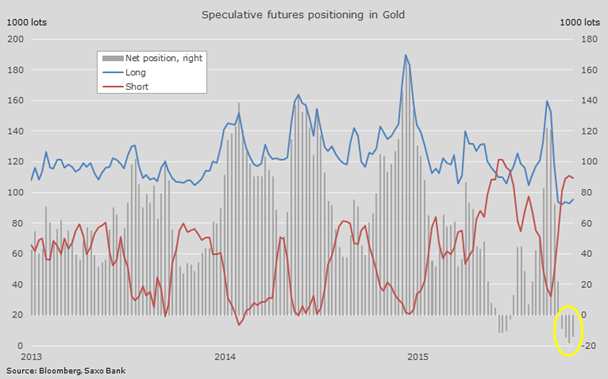

Gold was subdued ahead of the conclusion of the Fed meeting tomorrow. The decision comes shortly after the price settlement for gold. If this announcement is more of a brisk tightening of monetary policy then it will end up dipping gold even lower than it already is. “That will be quite positive for gold”. As the graphs shows US Treasury yields and the gold price have a strong negative correlation and a stronger dollar has an even closer inverse relationship to commodity prices in general.

On Wednesday, stock markets rose and the dollar held steady against the euro and a currency basket as investors readied for the expected rise.

Prices dropped a bit in the moments after the Fed’s rate announcement at 2 pm ET, but have since leveled off near USD1,1070.

Advertisement

A gradual pace of rate increases revives the chance that inflation, which has remained tame in recent years, could flare higher and reanimate demand for gold as a store of value.