-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

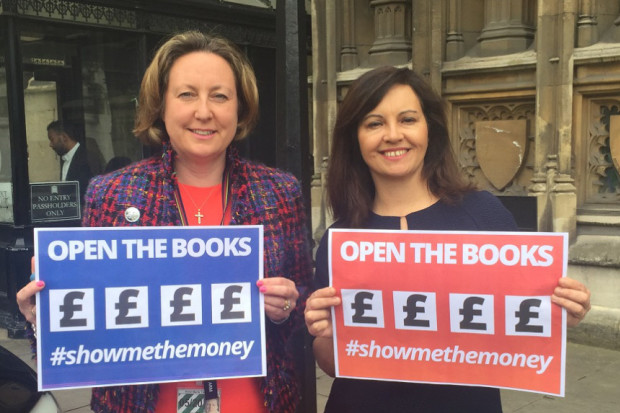

Government backs country-by-country tax reporting amendment

New UK legislation could force multinational corporations to reveal the taxes they have paid in every country in which they operate thanks to an amendment passed last night in parliament.

Advertisement

Speaking during a debate on the plans, Treasury minister Jane Ellison said the government believed in “greater tax transparency and greater public disclosure of the tax affairs of large businesses”.

Labour MP Caroline Flint has led calls for so-called “country-by-country reporting” to be introduced as part of the Finance Bill, which is now making its way through Parliament.

This means that they can require multinational businesses, headquartered or with sizeable business in the United Kingdom, to publish headline information about the size and location of the profits they make and the taxes they pay.

The amendment comes after the European Commission ruled on 30 August, that technology giant Apple should pay €13bn in back taxes from 2005 to Ireland, in an alleged sweetheart deal with the country. The amendment would give the government the power to implement public reporting “when appropriate”, but its introduction should not put UK-headquartered corporate groups “at a competitive disadvantage”, she said.

But Flint said this represented the equivalent of just GBP50 in tax for every GBP1 million in profit – all in the face of Ireland’s low corporation tax rate of 13%. “This enabling power will ensure that the United Kingdom has the scope to strengthen its influence on global tax transparency negotiations and it will build a greater consensus”.

Advertisement

The amendment to the Finance Bill had been backed by 60 MPs.