-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

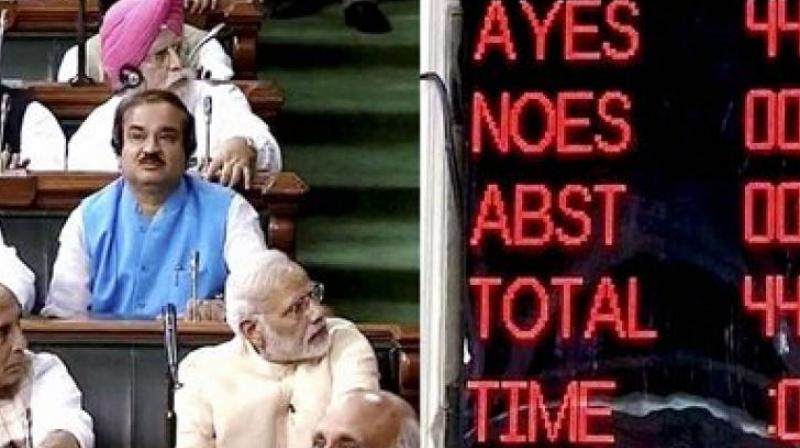

GST will end tax terrorism, corruption and help states: Modi

Moved by Finance Minister Arun Jaitley, the bill saw 443 members voting in favour of it and none against it. However, once the GST Constitutional Amendment Bill gets through the Lower House, Modi government must look out for “speedy steps” for an early implementation of GST.

Advertisement

On May 6, 2015, the Bill was passed by Lok Sabha and transmitted to Rajya Sabha for concurrence.

Goods and services tax (GST) rollout across the country will improve ease of doing business and encourage industries to expand their operations, which in turn will help boost job opportunities, experts say.

“Entire nation should be taken into confidence before passing such bills and that’s why bills like these can not be brought as money bills”, he said, adding that Congress was all for the bill.

“Yeh GST bill aisa hai, jisme garibo ke liye upyogi jitne cheeze hain tax ke daayre se bahar hain [This GST bill is such that everything that are essential for poor are out of the purview of tax]”, Modi said. “It is the victory for the democratic ethos of India and a victory for everyone”, Modi said, noting that all parties had risen above the differences in ideologies in support of the amendment. We were the first to bring the GST.

Trying to answer various issues raised by members, including M. Veerappa Moily and Mallikarjun Kharge (both Congress), the Prime Minister said that the new law will benefit states, especially those which are considered backward. “The CEA made a presentation before state FMs and every FM said their calculation was different”.

The Congress is a minority in the Lok Sabha with only 45 of the 543 members of the house from their party. Today, he said, the country would begin its march towards freedom from tax terrorism. The prime minister had addressed the Lower House of Parliament on Monday ahead of the vote, and argued for the Bill that will pass the uniform indirect tax. “If there was political consensus in 2011, this Bill would have been passed then”, he said.

In this context, getting the GST amendments passed through Lok Sabha will be a cake-walk for Modi government.

Modi repeatedly tried to reach out to the Opposition, giving credit to states and almost 90 political parties with whom deliberations were held.

The new regime – the idea for which was mooted some 13 years ago – seeks to subsume all central indirect levies like excise duty, countervailing duty and service tax, as also state taxes such as value added tax, entry tax and luxury tax, to create a single, pan-India market.

The new bill, his party believes, will help small and medium entrepreneurs, he said.

Advertisement

Subbarao said there are a number of steps to be concluded before GST becomes operational in reality.