-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

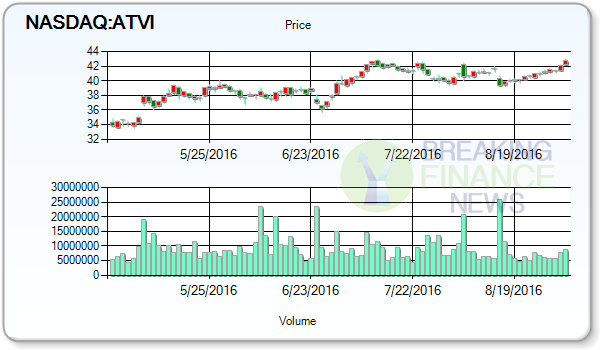

How Many Activision Blizzard, Inc. (NASDAQ:ATVI)’s Analysts Are Bearish?

Bank of America Corp. (Blizzard) and its subsidiaries, and Other segments.

Advertisement

Standard & Poor’s upgraded ATVI stock following second-quarter results that exceeded analysts’ expectations. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Dennis M. Durkin sold 119,937 shares of the stock in a transaction that occurred on Tuesday, August 30th. The stock price is moving up from its 20 days moving average with 4.23% and isolated positively from 50 days moving average with 9.18%. They now own 598.35 million shares or 17.54% more from 509.05 million shares in 2016Q1. The disclosure for this sale can be found here. Following the completion of the sale, the chief executive officer now directly owns 797,049 shares in the company, valued at $32,288,454.99. Activision Blizzard reported Q2 earnings of 54 cents vs. a Capital IQ estimate of 42 cents. NEXT Financial Group Inc now owns 6,071 shares of the company’s stock worth $240,000 after buying an additional 850 shares in the last quarter.

Several other equities analysts also recently weighed in on ATVI.

Sell-side analyst recommendations point to a short term price target of $45.82 on the shares of Activision Blizzard, Inc. Vetr downgraded Activision Blizzard from a “hold” rating to a “sell” rating and set a $40.89 target price on the stock.in a research report on Monday.

Analysts await Activision Blizzard, Inc. Piper Jaffray Cos. reiterated an overweight rating and set a $42.00 price objective on shares of Activision Blizzard in a report on Wednesday, July 27th. Commonwealth Equity Services Inc increased its stake in Activision Blizzard by 0.6% in the first quarter. Rating Scale; where 1.0 rating means Strong Buy, 2.0 rating signify Buy, 3.0 recommendation reveals Hold, 4.0 rating score shows Sell and 5.0 displays Strong Sell signal. AMX holds price to earnings ratio of 29.02 that presents much better indication for a stock’s value than the market price alone.

Just yesterday Activision Blizzard (NASDAQ:ATVI) traded 1.54% higher at $42.80. The stock has a market cap of $31.73 billion and a PE ratio of 43.10.

The stock’s 50 day moving average is 40.99 and its 200 day moving average is 36.97. The 52 week high shares of Activision Blizzard have reached is 43.1 whilst the 52 week low for the company’s shares is 26.49.

Activision Blizzard (NASDAQ:ATVI) last issued its quarterly earnings data on Thursday, August 4th.

Next Quarter Estimate Trends: A current consensus EPS estimate for next quarter is established at $0.78 and three month ago EPS estimation was $0.85. The firm’s revenue was up 112.0% compared to the same quarter previous year.

At the current price Activision Blizzard, Inc.

Advertisement

Activision Blizzard (ATVI) gave its flagging “World of Warcraft” PC game franchise a boost with the release of a new software expansion pack called “Legion”. The Firm operates through Activision Publishing, Inc.