-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

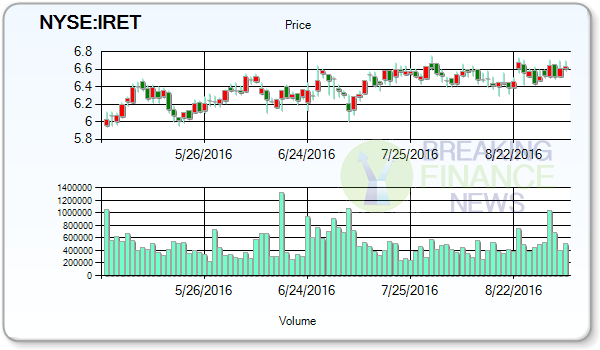

Investors Real Estate Trust (IRET) Announces Quarterly Earnings Results, Meets Expectations

Shares were Downgraded by Robert W. Baird on Jul 7, 2016 to ” Neutral” and Lowered the Price Target to $ 7 from a previous price target of $8. They now have a Dollars 31 price target on the stock.

Advertisement

Monmouth Real Estate Investment Corporation is a self-administered and self-managed real estate investment trust (REIT). Three research analysts have rated the stock with a hold rating and three have issued a buy rating to the company’s stock.

09/11/2014 – Capstone began new coverage on Washington Real Estate Investment Trust giving the company a “equal weight” rating. Monmouth Real Estate Investment Corporation has a 52-week low of 9.08 and a 52-week high of 14.70. (NYSE:ACRE) opened at 12.77 on Friday. The stock has an average rating of “Buy” and a consensus price target of C$40.28. The company has a market cap of $352.69 million. (NYSE:ACRE) last issued its earnings results on Thursday, August 4th. They presently have a C$43.00 price target on the real estate investment trust’s stock. The company posted revenue of $49.60 million in the period, compared to analysts expectations of $48.15 million. The business’s revenue for the quarter was up 10.2% compared to the same quarter past year. During the same quarter in the prior year, the business earned $0.31 EPS. The formula to calculate ratio is stock’s latest price/ per share earnings. Stockholders of record on Thursday, September 15th will be paid a $0.13 dividend. This represents a $1.04 dividend on an annualized basis and a yield of 8.14%. The ex-dividend date of this dividend is Tuesday, September 13th. 381,284 shares of the stock traded hands. They now have a United States dollars 11.5 price target on the stock. Following the transaction, the director now directly owns 15,069 shares of the company’s stock, valued at approximately $187,759.74. The Company’s tenants include World Bank, Advisory Board Company, Booz Allen Hamilton, Inc., Squire Patton Boggs (USA) LLP, Engility Corporation, Hughes Hubbard & Reed LLP, Epstein, Becker & Green, P.C., Morgan Stanley, Smith Barney, General Services Administration and SunTrust Bank. Edge Wealth Management LLC increased its position in shares of Ares Commercial Real Estate Corp.by 39.1% in the second quarter. They now own 16.68 million shares or 10.85% less from 18.71 million shares in 2016Q1. National Planning Corp increased its position in shares of Ares Commercial Real Estate Corp.by 7.0% in the first quarter.

Advertisement

Recently analysts working for numerous investment brokerages have updated their research report ratings and price targets on shares of Washington Real Estate Investment Trust (NYSE:WRE). It operates in two divisions: principal lending and mortgage banking.