-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Iran Oil Minister says Will Keep Raising Production

Iran oil production has surged since the West lifted nuclear-linked sanctions in January, with the country’s oil minister saying Sunday that exports of the commodity had now passed two million barrels per day.

Advertisement

But in an interview published Friday, April 1, Saudi deputy crown prince Mohammed bin Salman reiterated Riyadh’s position that other major producers, including Iran, would need to do the same.

A meeting between major oil producers will take place in Doha, Qatar, on April 17.

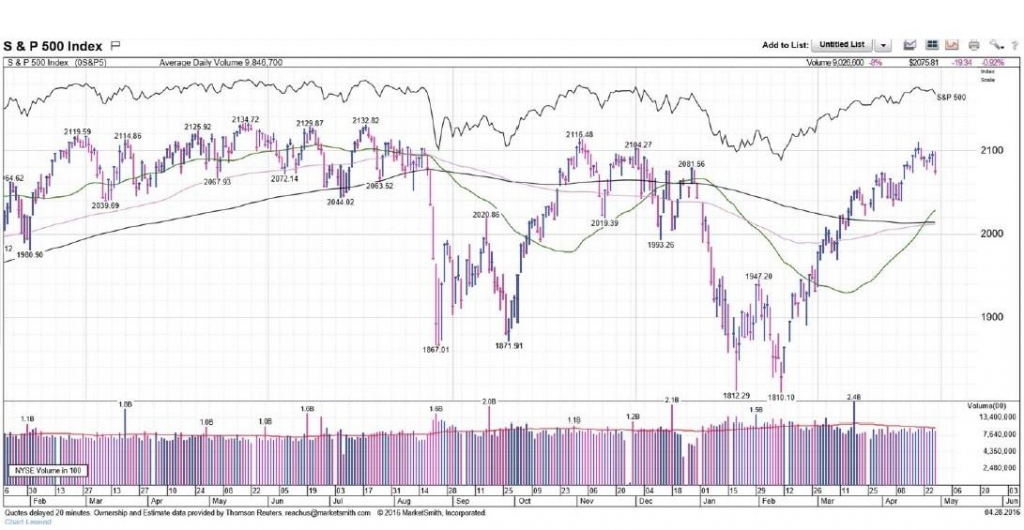

US crude futures were at $36.39 per barrel at 0554 GMT, down 1.06 percent or 40 cents from their last settlement, while Brent crude was down 0.9 percent or 34 cents at $38.33.

Despite the recent downturn, both the global and USA domestic benchmarks of crude are up by more than 18% since falling to multi-year lows in mid-February.

Iran’s oil output at present is calculated at 2.93 million barrels per day (bpd).

Adding to concerns of a global glut which has pulled down prices by as much as 70 percent since 2014, USA production has remained high despite steep cuts in drilling for new reserves as well as a jump in bankruptcies. In order to stabilize prices, oil producers are going to freeze output at the level of January 2016. “People who follow this were coming around to the position that even if an agreement could be reached to freeze output without Iran, it wouldn’t amount to anything”.

“There is a bit of a risk-off theme at present with oil prices down and equities in negative territory in the US”, Khoon Goh, a senior foreign-exchange strategist at Australia & New Zealand Banking Group in Singapore, said.

It shows how Saudi Arabia, Nigeria and Venezuela are among the worst affected by the slump in oil price, while India, China and the United States get a small benefit by virtue of being net importers. However, Iran is insisting on its right to hike production back to pre-sanctions levels.

Four hundred and thirty-five years after Francis Drake circumnavigated the world, and we continue to see the same themes circling the oil market at the start of this new week.

Advertisement

This has cast doubt on the ability of the world’s largest exporters to reach any such agreement when they meet this month in Doha to discuss how best to align global supply and demand.