-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Iraq Says OPEC Will Pursue Output-Freeze Talks at June Meeting

“We’re going to secure our market share as it was before sanctions, ” Seyed Mehdi Hosseini, chairman of Iran’s Oil Contract Restructuring Committee, told reporters in Paris.

Advertisement

The pan-European benchmark had opened sharply lower as oil prices CLK6, -4.39% LCOM6, -4.20% fell.

Freed from a plan to coordinate output with OPEC members, Russian officials said Tuesday that the country may boost both production and exports, writes Bloomberg.

“In the near-term, lower oil prices are bound to weigh on investor confidence and could exacerbate financial volatility”, Reuters quoted Frederic Neumann, co-head of Asian economics research at HSBC, as saying.

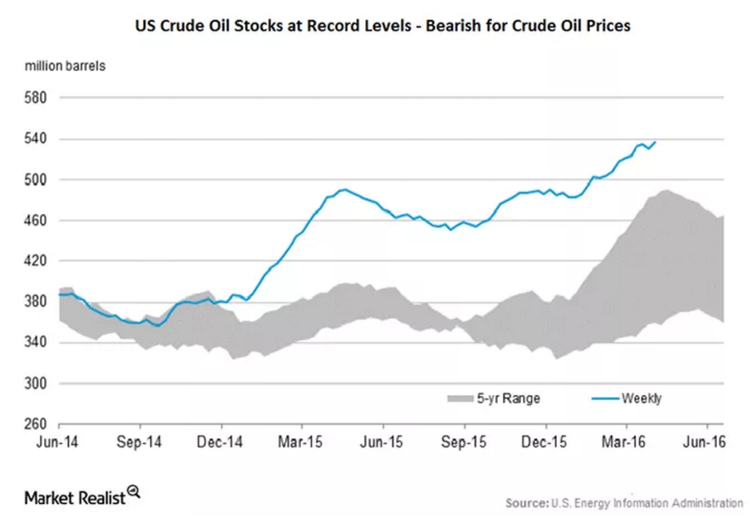

Oil prices are likely to remain under pressure for some time.

Iran didn’t even show up for the talks after saying initially that its OPEC representative would attend.

The IEA noted signs that “the much-anticipated slide in production of light, tight, oil in the United States is gathering pace”. Since it costs more to extract oil from American shale than a Saudi oilfield, the surplus of cheap foreign supply will force cutbacks from USA producers. Despite the absence of stable oil sales, results of the meeting in Doha will put pressure on oil quotes in the near future. “Artificial intervention in the market comes with risk and that is why it is best to let the markets rebalance themselves”. Although the objective of the meeting was to discuss a potential global production freeze, Saudi Arabia and Iran could not agree over Iran’s participation in such a freeze.

The deal aimed to stabilize markets after oil prices hit a 13-year low of some $27 (23.89 euros) in February, down from over $100 in mid-2014.

Crude prices dropped on Monday after the failed talks and have since rebounded as oil workers in Kuwait continued a strike for a third day, cutting production. The breakdown of talks will nearly certainly lead to another rout in oil prices over the next few weeks – but the pain could be short-lived. “Other oil producing countries are not expected to increase the output”, Natig Aliyev said.

Advertisement

OPEC will meet again in June. Rather than coordinated production cuts by the cartel, the market may see unilateral actions from individual countries.