-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

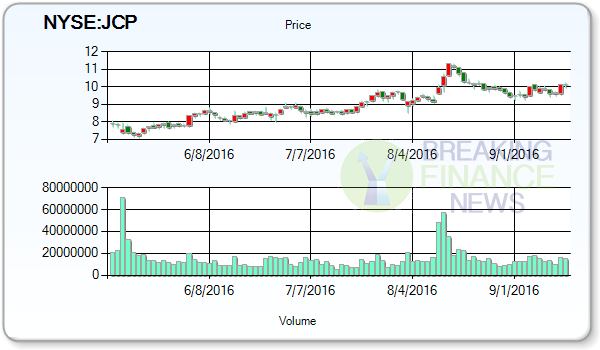

J.C. Penney Company, Inc. Holding Company (NYSE:JCP)

Investors evaluating JCP stock at the current market price of $10.1/share should know the company will next release quarterly results for the October 2016 quarter.

Advertisement

Presently, Analysts decided consensus EPS estimate of $-0.19 for present quarter and one month ago projected EPS estimate was at $-0.20.

Analysts’ mean recommendation for J. C. Penney Company, Inc.’s (JCP) stands at 2.50. The company has a consensus rating of “Hold” and an average target price of $11.52. Robert W. Baird raised J.C. Penney from a “neutral” rating to an “outperform” rating and set a $12.00 target price on the stock in a report on Thursday, May 26th. The company’s net profit margin has achieved the current level of -2.6% and possesses 36% gross margin.

J. C. Penney Company, Inc.

Recent Sales Surprise: During the recent quarter period Quarter Ending Jul-16, the company declared sales of $2,918.00M. For the prior quarter revenue for the stock hit $2.81B, with EPS at -$3.20E-01.

The research group Zacks updated its research report on J C Penney Company Inc (NYSE:JCP), which stated that its stock can hit $20 in the approaching fiscal. Holding Company is expecting Growth of -28% per annum, whereas in the past 5 years the growth was 9.37% per annum. RSI is a technical indicator of price momentum, comparing the size of recent gains to the size of recent losses and establishes oversold and overbought positions. Analyst’s mean target price for Advanced Micro Devices, Inc. The price to book (P/B) ratio of the company is 2.46. The stock tapped a 52-week high of US$11.49 while the 12-month Consensus Price Target is US$41.15.

Starbucks Corporation (NASDAQ:SBUX) traded 10,198,400 shares on last trading day with closing price of $53.74. The firm has institutional ownership of 91.90%, while insider ownership included 0.50%. J.C. Penney has a 12 month low of $6.00 and a 12 month high of $11.99.

Receive News & Ratings Via Email – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings with MarketBeat.com’s FREE daily email newsletter. Trading volume was was up over the average, with 15,258,111 shares of JCP changing hands over the typical 14,281,600 shares.

Beta is also an important valuation ratio for analyzing the stock of the company, 73 has Beta of 0.93 while its industry and Sector’s beta remains at 0.83 and 1.26 respectively.

The company shows its Return on Assets (ROA) value of -3.5%.

Advertisement

While looking at the Stock’s Performance, J.C. Penney Company, Inc. It is even a major constituent used to compute the price-to-earnings ratio. So far this year the stock has jumped 51.65% as investors are hopeful that the trend can continue into the 2nd half of 2016. The stock has a 1-year performance up 3.27% and a positive weekly performance at 2.02%.