-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Janet Yellen leans toward raising interest rates in near future

Chances of a Federal Reserve interest rate increase by July rose significantly Friday when Fed Chair Janet Yellen said a hike could be justified “in the coming months”.

Advertisement

US stocks extended gains on Friday to close higher as investors took comfort from Federal Reserve Janet Yellen’s speech.

As currency traders bet USA interest rates would soon rise, the Australian dollar shed about one-third of US1c, to fall below US72c early Saturday. With the US economy showing signs of improvement, though, the odds of a rate hike – the first since December of past year – are rising.

The United States revised its first quarter GDP data on Friday to a year-on-year growth rate of 0.8% from 0.5% flashed in the preliminary data last month.

This leaves the door open for a move as soon as the Fed’s next policy meeting June 14-15 or at its gatherings in July or September if officials prefer to wait for more economic data. An account of the Fed’s most recent meeting, in April, said it was thinking about a June increase, and several of Yellen’s colleagues have made the point explicitly in recent speeches.

Last month trading in federal funds rate futures contracts showed that markets gave a June hike a less than five percent possibility.

The Dow Jones Industrial Average rose 44.93 points, or 0.25 percent, to 17,873.22.

The Nasdaq Composite added 0.65 per cent to 4,933.51.

As per the data of Commerce Department, the U.S. gross domestic product (GDP) rose at a 0.8 percent annualized rate in the first quarter, which was up from the 0.5 percent estimated earlier.

Also on Friday, the University of Michigan’s Consumer Survey Center said consumer sentiment fell 1.1 points in May from the flash reading when it surged almost 7 points to 95.8, the strongest monthly improvement in a decade. The shift in sentiment shows traders may be giving more credence to the Fed’s projection of two more rate boosts this year, after policy makers lifted their overnight benchmark from near zero in December.

Economists say the FOMC would want to see an increase in employment of 160,000 to 200,000 positions to have confidence that the economy can withstand a rate increase. “We will monitor incoming data and risks”.

GameStop fell 3.93 per cent after the video-game retailer forecast lower-than-expected revenue and profit for the current quarter. Yellen has voiced concerns on raising rates too quickly as inflation was well below Fed target of 2 per cent and global economy continues to remain feeble.

Advertisement

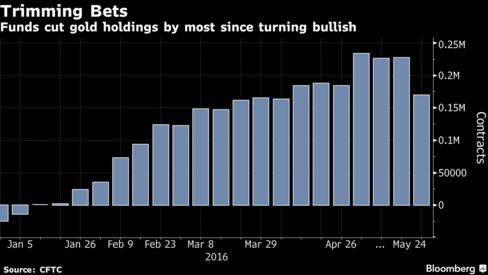

But Japan’s Nikkei stock index added 0.9 percent, as the yen weakened and expectations rose that the government would delay a sales tax hike scheduled for April next year. “When you get something that’s up 20 percent in the course of a few months, you’d expect a pullback”.