-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

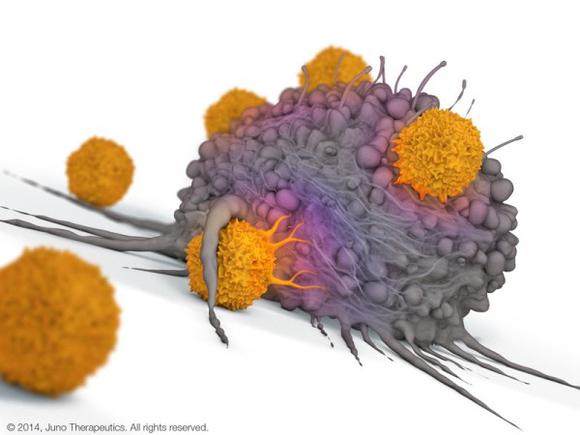

Juno shares surge on news of $1 billion payment from Celgene

Biotech startup Juno Therapeutics (NASDAQ:JUNO) was up 21% in midday trading Tuesday as analysts weighed in on its $1 billion deal with Celgene (NASDAQ:CELG) announced late Monday. Celgene will have the right to nominate a member to Juno’s board and during the tenure of the 10-year deal, Celgene has contingent rights to purchase up to 30% of Juno common stock.

Advertisement

Though still in early-stage testing, CAR-T cell technology has induced remarkably high remission rates in some forms of blood cancer.

Cantor Fitzgerald analyst Mara Goldstein weighed in with a few of her opinions on Celgene Corporation (NASDAQ:CELG) following the company’s $1 billion collaboration with Juno Therapeutics Inc (NASDAQ:JUNO) for access to CAR-T therapies to up its immune-oncology exposure. For Juno Therapeutics Inc, there were no purchases of shares in the first half of the year.

Celgene can further choose two or three candidates for a profit-sharing arrangement, with Juno taking 30% of both costs and profits and Celgene the other 70%. “Together with our planned fully-human CD19 CAR-T cell trial, combination study with AstraZeneca’s anti-PDL-1 antibody, and ongoing translational clinical trial with JCAR014, it will provide important biologic insights that will inform our future strategies”. B-Cell Maturation Antigen (BCMA) is excluded as a target in this collaboration. Celgene’s R&D head, Thomas Daniel, said that the firm considered the efforts to exceed the sum of the parts. However, Sanford C Bernstein & Company’s biotechnology analyst, Geoffrey Porges, said that the transaction suggests prepaying most of the cost of a distance asset before its delivery.

Celgene entered into a standstill agreement and agreed to certain lock-up provisions on its share ownership. Juno’s other product candidates include JCAR018: CD22, JCAR023: L1CAM (CD171), JCAR020: MUC-16 / IL-12, ROR-1 and JTCR016: WT-1.

In turn, Juno will have the option to enter into a co-development and co-commercialization agreement on certain Celgene-originated development candidates that target T cells, with Celgene leading global development and commercialization, subject to a Juno co-promote option in the US and certain EU territories, for Celgene-originated programs co-developed under the collaboration.

Some analysts have said that investors have become overly enthusiastic about engineered T cells, given that the therapies can have severe side effects.

Celgene will be responsible for development and commercialization in the rest of the world, and will pay Juno a royalty on sales.

Juno will remain responsible for research, development and commercialization in North America.

Advertisement

Juno’s initial approach, supported by investigators at Memorial Sloan-Kettering and the Fred Hutchinson Cancer Research Center, has been to target hematological malignancies like acute lymphoblastic leukemia and non-Hodgkin lymphoma. Subject to additional obligations, which the companies didn’t disclose, Celgene also may select a third program for co-promotion.