-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

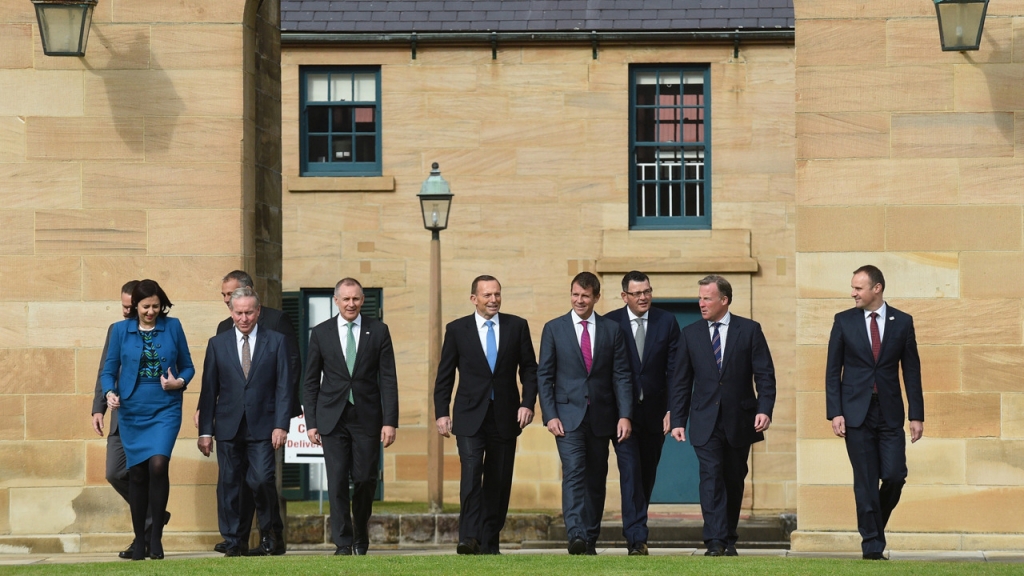

Leaders aim to end online GST loophole

Ms Palaszczuk, who will fly to the special Council of Australian Governments’ leaders retreat in Sydney on Wednesday, was closed-lipped on her own ideas for tax reform heading into the meeting.

Advertisement

In an opinion piece published on Monday, Mr Baird said the current state of the federal-state financial system meant Australia’s capacity to deliver quality health care was compromised. West Australian Premier Colin Barnett has backed a GST overhaul, to increase the rate to 12.5 per cent and extend it to online goods and fresh food, according to The West Australian.

The only problem with a tax like the GST is that it affects lower income families more – because it represents a larger slice of their take-home income than those well off. Mr Baird suggests that offering a compensation package for those households earning up to $100,000 would ensure they weren’t disadvantaged.

The Victorian Labor premier, Daniel Andrews, said Abbott had already broken his promise not to cut health and education funding and would now “like everyone to pay for his lie” by increasing the GST.

There does seem a consensus that Mr Baird has explained a simple truth: none of them can afford to pay for the health system voters currently have and expect to keep in the future.

“I know that’s not popular, I know that’s not something that people want to talk about, but unfortunately we must”, he said.

Despite all this, significant hurdles remain. The premier accused federal Treasurer Joe Hockey of trying to do just that.

Andrews has instead proposed an increase in the Medicare levy to alleviate the skyrocketing costs of health. “The best way of dealing with this is to increase the GST”, he says. But this is at odds with both Mr Hockey and the Prime Minister.

The summit was called to try and find a long-term funding solution for public health and education. prompted after the Commonwealth withdrew $80 billion in long-term funding in the 2014 budget.

MR Baird, speaking after two days of discussions with Prime Minister Tony Abbott and other state leaders, said they would look at the GST and the Medicare levy in detail with the aim of raising much-needed revenue.

GST is a value added tax of 10% charged on most goods and services, introduced by the Howard government in July 2000.

He said compensating low income-earners was “just putting lipstick on a pig”.

Pressed on where that left him in relation to his party’s position, Mr Weatherill replied that he had a state to govern and “didn’t have the luxury of opposition for opposition’s sake”.

“There’s no doubt there is a gap between what we have and what we need to fund basic services in health care”.

TASMANIAN Premier Will Hodgman remains opposed to a rise in the GST despite New South Wales Premier Mike Baird backing a rise to 15 per cent.

Its official objective is to provide input to the Government’s federation white paper.

Advertisement

With the change of government came a change with Queensland’s stance on the issue.