-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

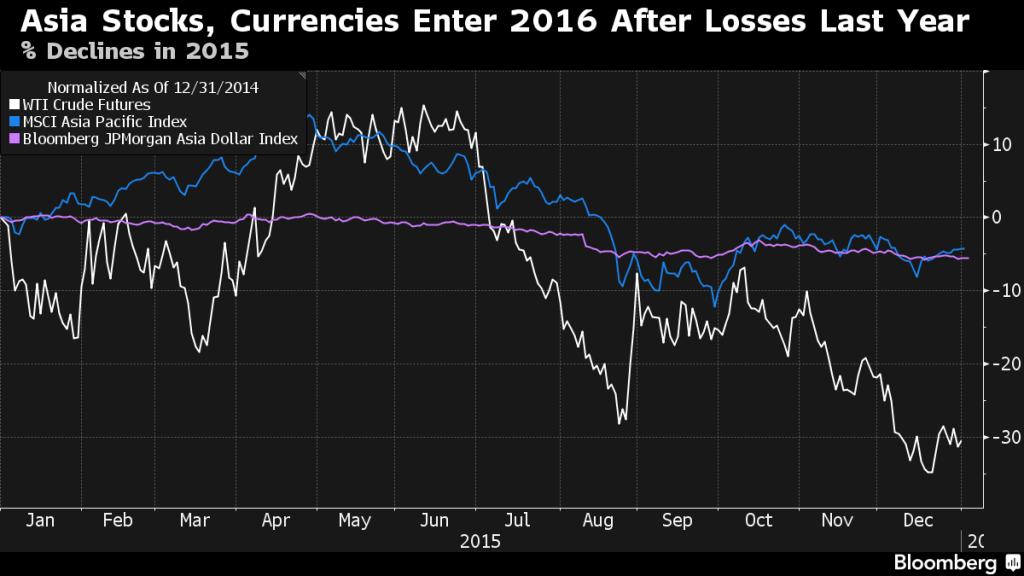

MARKET & ECONOMICSTrading in Chinese stocks halted after prices plunge

Asian stock markets started 2016 on a weak note Monday as poor manufacturing data from the world’…

Advertisement

Guests watch an electronic stock board showing the first day trading of the year figure during a ceremony marking the start of this year’s trading in Tokyo, Monday, Jan. 4, 2016.

Stocks had more than doubled in the 12 months leading up to the first of a series of plunges, as state media encouraged the public to invest.

United Kingdom stocks kicked off the new year sharply lower on Monday, after steep drops in China’s equity market fueled a selloff across Europe.

In New York, the Dow Jones average was down 447.16 points or 2.57 per cent at 16,977.87, the broader S&P 500 index declined 51.34 points or 2.51 per cent to 1,992.60 and the Nasdaq lost 143.01 points or 3.11 per cent to 4,450.26.

It was subsequently followed by other Asian indices such as the Hong Kong Hang Seng, down 2.8%, and the Nikkei 225, which closed 3.1% lower.

The Dow’s decline was as much as 2.4 percent. Markets in Shanghai and Shenzhen are slowly opening to foreign investors, but many barriers to direct ownership remain.

The suspension of markets in China is a new circuit-breaker measure introduced in early December, created to limit the volatile trading the nation suffered last summer as its economy slows.

Escalating tensions in the Middle East, sparked by Saudi Arabia’s execution of a prominent Shia cleric over the weekend led to a jump in oil prices, adding to today’s uncertainty.

The UK blue-chip index, which dropped nearly 5 per cent previous year, fell to 6,118 on the first day of 2016 trading, with resources companies once again feeling the pain.

Under the Indian rules, a rise or fall of 10 per cent in benchmark index triggers a trading halt across the market for 45 minutes, if such a movement takes place before 1 pm, while halt is of 15 minutes, if a 10 per cent movement happens between 1 pm and 2.30 pm.

The Middle East tensions is already causing turbulence in the oil markets.

The Caixin PMI is a closely-watched gauge of nationwide manufacturing activity focusing on smaller and medium-sized companies that aren’t covered by the official data.

The Shanghai Composite Index dived 6.9 percent to 3,296.66, its lowest level in almost three months. European stocks also slumped.

“The market is anxious about the upcoming lifting of the rule that bans shareholders from selling”, Central China Securities analyst Zhang Gang told AFP. Saudi Arabia said yesterday it is severing diplomatic relations with Iran, a development that could potentially threaten oil supplies. The euro fell to $1.0822 from $1.0858.

Advertisement

Fresh data this week will offer investors more clues into the health of the US economy, including the Institute for Supply Management’s purchasing managers index later Monday.