-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

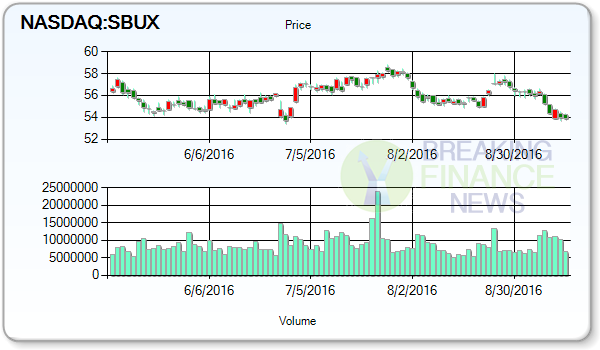

Midday Session Look and Stock Target Update for Starbucks Corporation (NASDAQ:SBUX)

At present, 0 analysts recommended Selling these shares while 5 recommended Hold, according to FactSet data. It also sells a range of coffee and tea products and licenses its trademarks through other channels, such as licensed stores, grocery and national foodservice accounts. Goldman Sachs Group Inc. upgraded shares of Starbucks Corp. from a “buy” rating to a “conviction-buy” rating and set a $69.00 price objective for the company in a research report on Tuesday, July 26th. The median estimate represents a 5.46% increase from the last price of 18.30. BTIG Research set a $64.00 target price on Starbucks Corp. and gave the stock a “buy” rating in a report on Monday. Analyst forecasts, earnings estimates and price target projections are issued to help their clients make money through stock investments. Capital Fund Management Sa who had been investing in Starbucks Corp for a number of months, seems to be bullish on the $78.30 billion market cap company.

Advertisement

Analysts are expecting that the company to achieve $65.92 Price Target in next 52-weeks, average price is come up through the consensus of analysts. It also reduced its holding in Expedia Inc (Call) (NASDAQ:EXPE) by 56,229 shares in the quarter, leaving it with 49,300 shares, and cut its stake in Intel Corp (NASDAQ:INTC).

Starbucks Corporation (NASDAQ:SBUX) remained bullish with an increase +0.39% putting the price on the $54.11 per share in last trading session ended on 9/15/2016. On Oct 30, 2015 the shares registered one year high at $64.00 and the one year low of $52.63 was seen on Feb 8, 2016. This appreciation has taken its market cap to $80.24B and a price-to-earnings ratio to 30.74. The firm shows a 20-Day Simple Moving Average of -4.30% with a 200-Day Simple Moving Average of -5.86%. At present, the Gross Margin for Starbucks Corporation SBUX Specialty Eateries is moving around at 31.20% alongside a Profit Margin of 13.00%. (NASDAQ:SBUX) last issued its quarterly earnings results on Thursday, July 21st.

The per share earnings for Starbucks Corporation were $0.49. 5 analysts have suggested the company is a “Hold”. When calculating in the EPS estimates for the current year from sell-side analysts, the Price to current year EPS stands at 28.3353. The ex-dividend date of this dividend was Tuesday, August 2nd. Starbucks Corp.’s dividend payout ratio (DPR) is 44.69%. The latest trading activity of 10.05 Million shares is below its average volume of 11.42 Million shares. The stock has relative volume of 1.12. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink.

A number of FactSet analysts shared their views about the current stock momentum. Advisory Services Network LLC increased its stake in shares of Starbucks Corp.by 0.3% in the second quarter. Pioneer Investment Management Inc. now owns 5,598,553 shares of the coffee company’s stock worth $336,082,000 after buying an additional 168,107 shares during the last quarter. Kentucky Retirement Systems bought a new position in shares of Starbucks Corp. during the second quarter valued at approximately $7,116,000. Narrow down four to firm performance, its weekly performance was -4.30% and monthly performance was -2.44%.

Advertisement

Deutsche Bank issued their verdict on Starbucks Corporation (NASDAQ:SBUX) recently. The Firm purchases and roasts coffees that it sells, along with coffee, tea and other beverages, and a range of fresh food items, through Company-operated stores.