-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Monsanto shares close below price offered in Bayer deal

Germany based chemical and pharmaceutical company, Bayer AG, has offered an all-cash deal to acquire a USA based seeds firm, Monsanto Co, for a total value of $62 billion.

Advertisement

Monsanto stock rose 5 percent to $106.61 by midday trading on the New York Stock Exchange – well below Bayer’s offer price, in a sign that it faces a tough task convincing the Creve Coeur-based company’s shareholders to sign off on the deal.

Bayer wants to buy Monsanto for $62 billion, hooking up the German chemical and drug company with the St. Louis-based producer of seeds and weed-killers.

In August previous year, Monsanto had abandoned its takeover bid for competitor Syngenta AG after the Swiss chemicals producer rejected its offer worth almost $47 billion. The payment would be funded with a combination of debt and equity, with about $15.5 billion coming from selling shares to existing investors. That came after a plunge on Thursday, when it confirmed that it had made an offer, without disclosing the details.

Shares of Monsanto India surged over 7 per cent after the government withdrew a notification capping royalty fee for new genetically-modified (GM) seed technology amid opposition from the biotech industry.

Bayer offered $62 billion to buy Monsanto Co.

The company’s operations in Research Triangle Park serve as both the North American headquarters of its crop science division as well as the global headquarters of Bayer’s seeds business. “If we get that right, we should be able to offer a superior package to farmers so they can increase their return on investment”, Bayer’s Condon said. Monsanto’s board is still reviewing this unsolicited proposal by consulting with financial and legal advisors. Monsanto produces agricultural products and has some of the leading seed brands in crops like corn, cotton, oilseeds, fruits, and vegetables, noted its website.

Bayer shareholders have also responded coldly to the company’s pursuit, condemned by one Bayer investor as “arrogant empire-building” when news of the proposal emerged last week. “Monsanto has an extremely bad reputation in Germany in the area of genetics”, said Elvira Drobinski-Weiss, who is in charge of GM issues within the SPD.

Bayer said it is prepared to proceed immediately to due diligence and negotiations. The combined company would have higher earnings and save $1.5 billion a year by eliminating overlap, Bayer says.

“It is our preference to work together with Monsanto to reach a mutually agreeable negotiated solution”, Bayer said.

Bayer, which employs about 117,000 workers, turned in record profits and sales previous year, notching up a net profit of 4.1 billion euros (US$4.6 billion) on sales of 46.3 billion euros. In a note to clients, Citigroup Inc. analysts Peter Verdult and Andrew Baum said they “would be surprised if Bayer’s first proposal was accepted outright”.

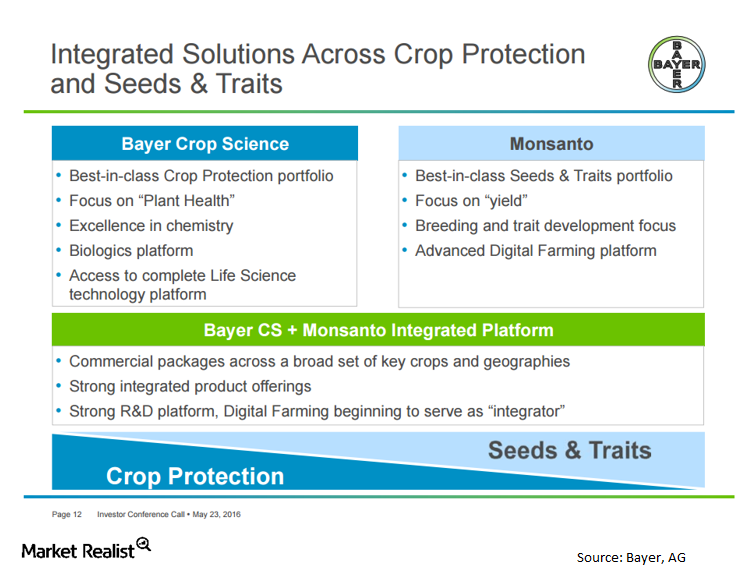

Bayer noted that a combination of its crop-science business with Monsanto would be “complementary” from both a product offering and geographic perspective.

Advertisement

Mr. Manns added he understood the strategic value of Bayer’s bid-to make itself a stronger player in the seeds business, where it has lagged behind-but argued the acquisition would be too large.