-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

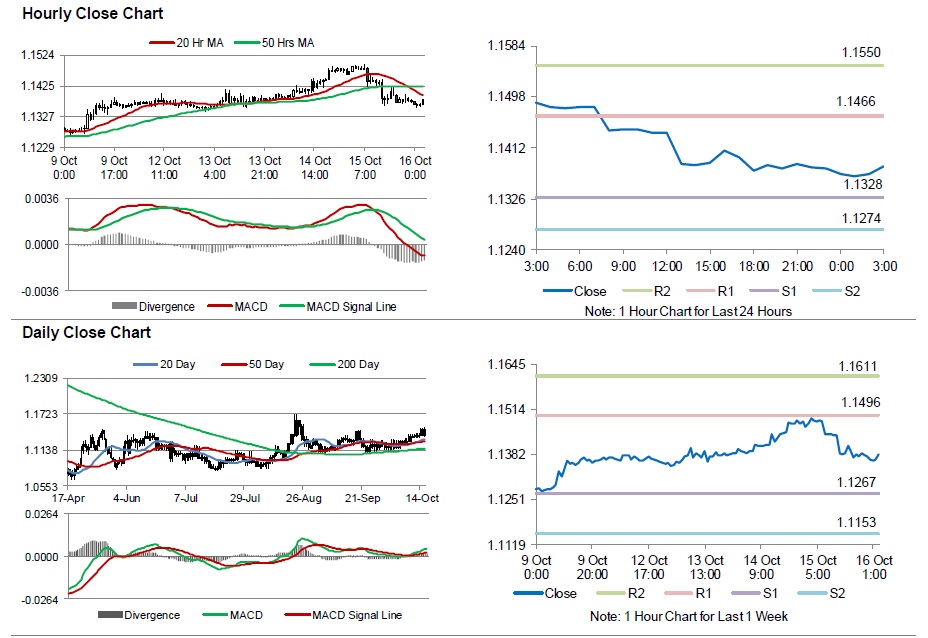

New measures needed to boost inflation – Nowotny

Gloomy figures on regional manufacturing from the New York and Philadelphia Feds also kept a lid on the dollar‘s rise. September’s U.S. Consumer Price Index data printed at 0.0% from the forecast -0.1% y/y and CPI ex food and energy printed at 1.9% when the market was forecasting 1.8% y/y.

Advertisement

The Euro tumbled across the board in early European dealing today on the back if comments by ECB member Ewald Nowotny who suggested that the central bank will need new instruments to include structural changes for further implementation of QE.

The dollar index stood at 94.487 after bouncing from 93.806 touched overnight, its lowest since late August.

In the Asian session, at GMT0300, the pair is trading at 1.1382, with the Euro trading marginally higher from yesterday’s close.

Although it is hard to surmise just what specific measure the European Central Bank would implement – it is highly unlikely for example that it would follow BOJs lead and begin buying equities as well as sovereign bonds – the comments by Mr. Nowotny clearly indicate that policymakers are concerned about the stalling recovery in the region and the persistent disinflationary forces still affecting the economy.

“Policy divergence as a driver for the dollar is seen as less tenable in the near term”, said Josh O’Byrne, a G-10 FX Strategist at Citigroup.

While the euro move gave the dollar a few respite, there is a broad feeling that the strong dollar environment that has dominated the past 18 months is fading.

Economists will likely firm up their expectations for interest rates following the data, ahead of the next Reserve Bank review on October 29.

“The weak data seen from the U.S., notably the disappointing retail sales, has actually increased (market) certainty because a Federal Reserve rate hike this year now seems highly unlikely”, said analyst Jasper Lawler at traders CMC Markets.

The euro slipped 0.1 percent to $1.1380, having slid from a 7-week peak of $1.1495 scaled the previous day after ECB’s Nowotny said it was “obvious” the central bank must seek more ways to stimulate the euro zone economy.

The greenback weakened further against the yen on bets the Fed would not raise rates in 2015 due to the weakening global outlook.

Advertisement

In Asia Thursday, Seoul closed 1.18 percent higher, Tokyo added 1.15 percent and Sydney gained 0.63 percent.