-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

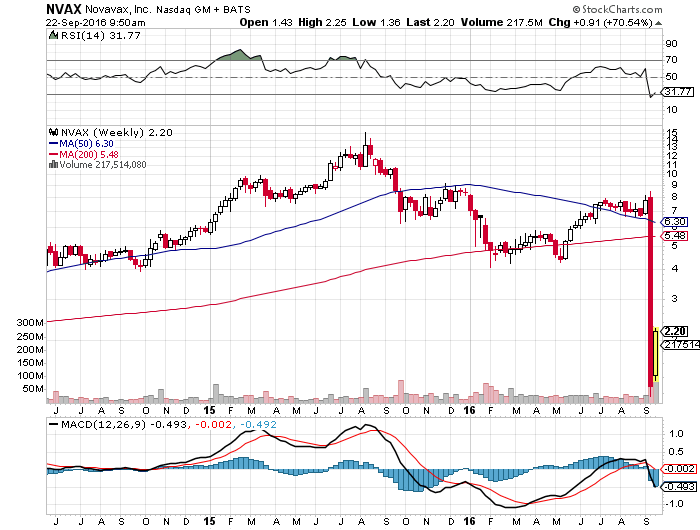

Noticeable Buzzers: Novavax, Inc. (NASDAQ:NVAX) , Endo International plc (NASDAQ:ENDP)

Citigroup Inc. downgraded shares of Novavax from a buy rating to a neutral rating and cut their price objective for the company from $12.00 to $1.50 in a research report on Friday, September 16th.

Advertisement

The company’s quick ratio for most recent quarter is 5.10 along with current ratio for most recent quarter of 5.10.

According to sentiments of 7 analysts the mean estimates of short term price target for the company’s stock is marked at $8.74. The Rating was issued on Sep 16, 2016.Novavax is Downgraded by JP Morgan to Neutral.

09/16/2016 – Novavax, Inc. was downgraded to “neutral” by analysts at Ladenburg Thalmann. Its Director BOUDREAUX GAIL Purchased 100,000 company shares for $145000, in a transaction on 2016-09-20. The stock recently traded at a volume of 0 shares versus average volume of 5.92M. (NASDAQ:AAPL). These ratios are important while doing valuation of the company or the shares of the company. However, the biotech has managed to rebound 85% off of its low of $1.16, though it still sits well below its pre-bear gap prices. Novavax has a 1-year low of $1.16 and a 1-year high of $9.88. The stock’s price fluctuated within the range of $1.45 – $1.94 during previous trading session. They now have a Dollars 1.5 price target on the stock. The Stock now has a Weekly Volatility of 14.65% and Monthly Volatility of 7.23%. The firm has a 50-day moving average price of $6.69 and a 200 day moving average price of $6.16. Novavax, Inc. (NASDAQ:NVAX) shares were trading -81.87% below from the 52-week high mark of $10.70 and +67.24% above from the 52-week bottom of $1.16. Earlier the firm had a rating of Outperform on the company shares. The biopharmaceutical company reported ($0.29) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.25) by $0.04. (NASDAQ:NVAX) from a sell rating to a hold rating in a report issued on Wednesday morning. During the same quarter in the previous year, the company posted ($0.08) EPS.

Novavax (NASDAQ:NVAX) last announced its quarterly earnings results on Tuesday, August 9th. The shares have been given a mean “BUY” rating keeping in view the consensus of “8” Analysts. The business’s revenue was down 82.1% on a year-over-year basis. The company now has a Return on Equity (ROE) of -112.40% and a Return on Investment (ROI) of -53.60%. Options volume is set to hit the 99th percentile of NVAX’s annual range, with nine of the 10 most active options today being calls. The purchase was disclosed in a filing with the SEC, which can be accessed through this link. Vanguard Group Inc. now owns 19,935,014 shares of the biopharmaceutical company’s stock valued at $144,928,000 after buying an additional 1,385,637 shares during the last quarter.

Receive News & Ratings for Novavax Inc Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Novavax Inc and related companies with MarketBeat.com’s FREE daily email newsletter.

Advertisement

Novavax, Inc. (Novavax) is a clinical-stage vaccine company focused on the discovery, development and commercialization of recombinant nanoparticle vaccines and adjuvants. The Company through its recombinant nanoparticle vaccine technology produces vaccine candidates to respond to both known and newly emerging diseases.