-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Nvidia revenue tops company estimate

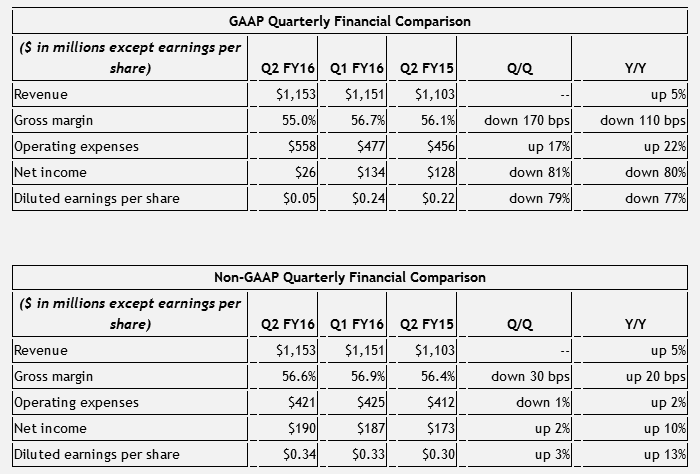

The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. By the end of the day NVIDIA‘s shares had surged 9.7%, and almost 2% over the year, which does not sound fantastic, however, when compared to the 11.6% fall in the Dow jones US chipmakers index NVIDIA’s performance this year has been solid. As per the latest data, 1 analysts has given a sell rating on the shares of the company. The firm has a market-cap of $12.36 billion and a price-to-earnings ratio of 20.52. Barclays boosted their price target on NVIDIA from $20.00 to $21.00 and gave the inventory an equal weight standing in a study report on Friday. Twenty-eight analysts had a consensus revenue estimate of $1.01 billion for the quarter. On an adjusted basis, NVIDIA’s earnings came rose to $0.34 per share from $0.30 per share.

Advertisement

In the last reported quarter, the company narrowly missed both earnings and revenue expectations.

In 2011, Intel agreed to pay Nvidia $1.5 billion spread out over six years. This represents a $0.39 dividend on an annualized basis and a yield of 1.70%.

Likewise, other research (not our own) has shown insider purchases are also effective piggybacking methods for investors that lead to greater returns. Oppenheimer reiterated a “hold” rating on shares of NVIDIA in a report on Friday. Tigress Financial upgraded shares of NVIDIA from a neutral rating to a buy rating in a report on Wednesday, June 17th. The stock has been rated by two research analysts with a sell rating, fourteen have given a hold evaluation and eleven have issued a buy rating to the company’s stock. The standard deviation of short term price target has been estimated at $3.28, implying that the actual price may fluctuate by this value.

NVIDIA Corporation (NASDAQ:NVDA) is engaged in visual computing, empowering individuals to communicate with digital notions, information and entertainment. The Organization is engaged in producing NVIDIA-branded goods and solutions, supplying its processors to original-equipment manufacturers (OEMs), and licensing its intellectual-property. NVIDIA-branded products and services are visual computing platforms that address four markets: Gaming, Enterprise, High Performance Computing & Cloud, and Automotive.

Nvidia may be making up for some of the revenue its losing in the shrinking PC market with increasing orders for chips used in high-end desktops. The Organization ‘s GPU product brands include Quadro for designers; GeForce for gamers; Tesla for investigators, studying and big data analyzers; and GRID for cloud -based visual users.

Advertisement

Huang added Nvidia is now collaborating with more than 50 companies on Nvidia’s Drive venture for self-driving cars.