-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

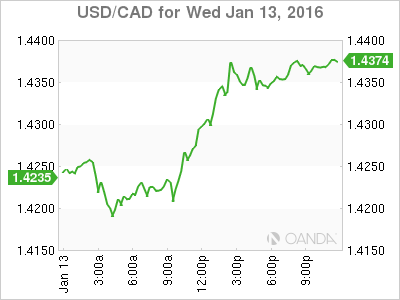

Oil dips below US$30

The loonie settled Wednesday at 69.71 cents US, down 0.43 of a cent since Tuesday’s close.

Advertisement

The dropping Canadian dollar, which has plunged below the 70 cent mark, could increase the grocery bills, particularly when it comes to purchasing fruits and vegetables.

“Most Canadian governments are using an oil price of between 50 to 60 US dollars to create their budgets for this year, it now looks like those numbers are farfetched”, said Smith.

On the commodity markets, the February gold contract was up $1.90 at US$1,087.10 an ounce and the crude contract was up 77 cents at US$31.21 per barrel.

Canada’s dollar dipped below 70 cents US on Tuesday for the first time in almost 13 years.

The 70 cent psychological threshold is unlikely to be the bottom and Canadians should brace for further declines and years of a weak dollar, predicted John Johnston, chief strategist at investment adviser Davis Rea.

The slumping loonie, dragged down by lower oil prices. now at a level not seen since may of 2003.

When the loonie is low compared to the United States dollar, Canadian exporters can more easily find new business.

Combined with recent volatility in stock markets across the world, he said, that global uncertainty is also causing people to flee for the safe haven of U.S. Treasury bonds, which pushes the value of the greenback higher against all other currencies, including Canada’s.

But oil prices are not the only factor.

Advertisement

A strong USA dollar plus low oil prices – bad news for an oil-producing country – put the loonie on the ropes. “What we’re not getting is clear evidence of the positive effect of lower oil prices, that is a bit of a surprise and that’s what the uncertainty is increasingly now”. Some analysts call for a rate cut as soon as next week when the central bank meets on Wednesday, January 20. As it turns out, he was even a month early.