-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Oil dips on stronger dollar, rise in US crude inventories

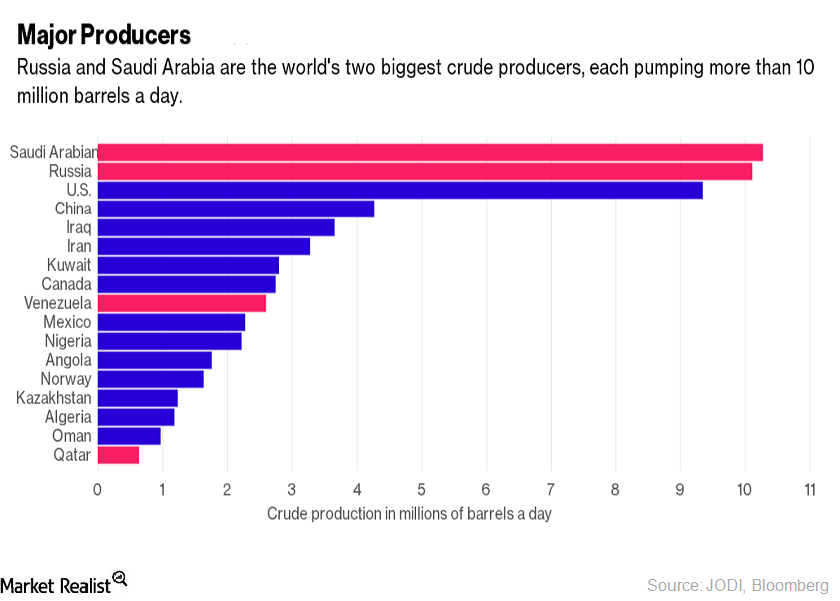

Crude oil prices have extended their decline in early Asian trade on Wednesday amid the improved strength in the U.S. dollar and growth in crude oil inventories.

Advertisement

At around 0415 GMT, US benchmark West Texas Intermediate was down one cent at $46.34 and Brent eased six cents to $48.31.

The target oil price for OPEC is rather below $100 a barrel, James Smith, professor at the US Southern Methodist University, said.

“A freeze based on current maximum production levels, or somewhere near that, may not have too much practical impact on the market”, said Ric Spooner, chief analyst at CMC Markets in Sydney.

Some observers also read a lot into a remark made last week by Bijan Namdar Zanganeh, oil minister for Iran, who said his country will participate in the freeze talks: Bob Yawger, director of the futures division at Mizuho Securities USA Inc., declared, “The news about the Iranian oil minister heading to Algiers is bullish; this increases the likelihood of an agreement to freeze production”.

Yet high oil stocks could limit any quick recovery in prices.

After the market settled, the trade group American Petroleum Institute reported that USA crude stockpiles rose 942,000 barrels last week, in line with expectations of analysts polled by Reuters. The U.S. government will release official inventory data on Wednesday.

As the storm continues to brew in the Gulf of Mexico, forcing producers to suspend activities and evacuate workers, crude oil prices continue to suffer.

Oil and gas operators in the U.S. GoM have shut output equal to 168,334 bbl/d of oil and 190 million cubic feet per day of natural gas as a precaution against a tropical storm, the U.S. Bureau of Safety and Environmental Enforcement said on August 29.

Oil prices fell on Tuesday as a stronger dollar dented market sentiment as it made the dollar-dominated oil less attractive for holders of other currencies.

Advertisement

However, a stronger dollar also played an important role in Tuesday’s price declines: the WSJ Dollar Index rose to a one-month high as investors continued to assess the outlook for USA interest-rate increases this year. OPEC sees the balance of supply and demand for its members in 2016 at 31.9 million barrels per day, with an increase of 1.9 million barrels compared to the previous year.