-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Oil edges lower amid scepticism about output freeze

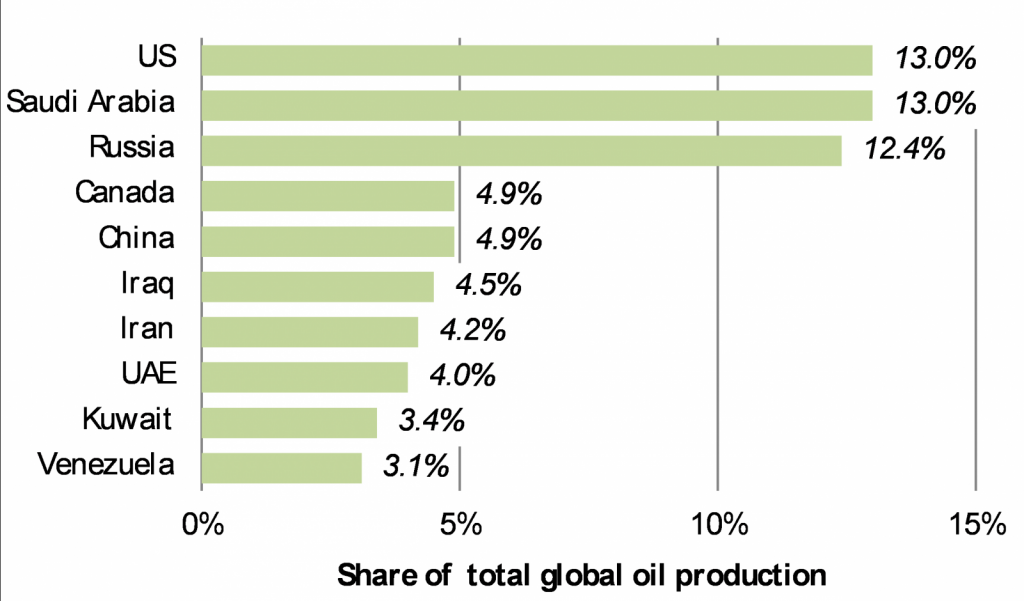

None other than Russian Federation ‘s leading man, Vladimir Putin and the newly minted Deputy Crown Prince of Saudi Arabia , Mohammed bin Salman came together to announce the signing of a joint statement by their respective oil ministers, which outlined aspirations of cooperation between the two countries, in the areas of technology and market information, to achieve market stability (i.e. get prices higher) along with the stated hope of bringing in other actors.

Advertisement

The ministers announced their countries would set up a joint task force to review the state of the oil market and recommend policy measures aimed at stabilizing it.

Iran has said it would cooperate on a freeze only if fellow exporters recognised its right to boost market share to levels reached before the imposition of nuclear-related sanctions, which have now been lifted.

Oil prices in overnight trading rallied further, but erased the gains by the start of trading in NY.

The catch 22 is obvious in that prices need to increase in order for production to increase, however, as production increases, prices decrease.

“We still can not shoulder the responsibility alone; we will play the leadership role and we will catalyse others to join in”, Al-Falih said.

Saudi Arabia has been raising output since 2014 to drive higher cost producers out of the market.

Even though strategists see the market as rebalancing from a deep oil glut, an oversupply of gasoline has also been working through the system after a summer of high production.

In a joint statement, the two countries confirmed they’ll hold further talks during the International Energy Forum in Algiers this month. It is unlikely a deal will be made as OPEC most likely cannot sustain lower production. But several members of the group, including Iran, Nigeria and Libya, are looking to increase output from current levels and will likely be unwilling to freeze production, analysts say.

OPEC and Russian Federation tried earlier this year to curb the glut by seeking an output freeze, but the deal collapsed in April due to tension between Saudi Arabia and Iran.

Novak said outright oil production cuts may also be discussed.

“It would appear the price spike on Monday was used as an opportunity for those who believe there will be no agreement on freezing output at this month’s unofficial OPEC meeting to sell oil futures”.

Advertisement

Iran, which is raising exports after the lifting of Western sanctions in January, refused to participate in the earlier effort to freeze output. Two companies – out of many in Singapore’s stock market – that have suffered from the effects of low oil prices are Keppel Corporation Limited (SGX: BN4) and Sembcorp Marine Ltd (SGX: S51).