-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Oil extends losses under $40

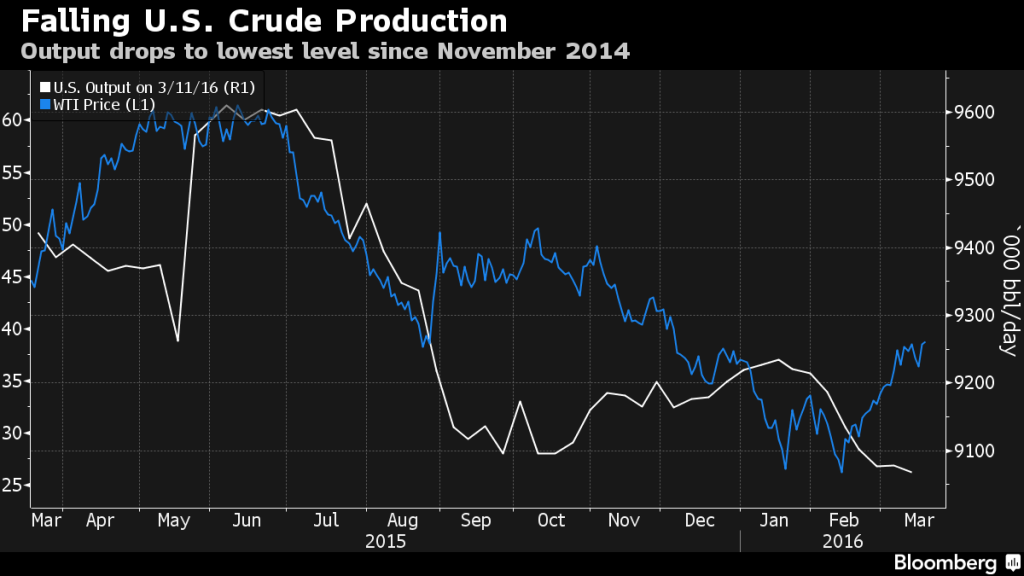

Oil prices rose on Wednesday after falling the previous session on expectations United States output will decline further as some producers are under increasing financial distress and as early inventory data showed a less-than-expected increase.

Advertisement

Brent for May settlement climbed as much as 52 cents, or 1.3 percent, to $39.26 a barrel on the London-based ICE Futures Europe exchange.

Around 1200 GMT, US benchmark West Texas Intermediate (WTI) for delivery in April was down 81 cents at $36. Commercial storage is at a modern-era record high, but the week’s built came in below the 3.2 million barrel build many had been expecting, according to a survey by Bloomberg. Because oil is priced in dollars, it becomes more affordable for buyers using foreign currency as the dollar weakens.

“The focus is always on the US, and if inventories rise less, it is a first indication that the market is less oversupplied”, Giovanni Staunovo, an analyst at UBS Group AG in Zurich, said by phone. “The country could consider curbing output when it reaches pre-sanctions level of 4 million barrels a day-still some barrels to go from current [levels of] around 2.8 million barrels a day”.

“By 2015, the number of fracked wells rose to an estimated 300,000, and production from those wells grew to more than 4.3 million barrels per day (MMBPD), 51% of the total oil output of the U.S.”, EIA said.

Also supporting oil futures was the announcement that major OPEC and non-OPEC oil exporters will hold talks in Doha, Qatar on April 17 to discuss a proposal to freeze output.

Crude oil rallied Wednesday as the Federal Reserve predicted two rate hikes in 2016 instead of four.

Oil prices surged Wednesday as a government report showed USA crude stockpiles increased less than expected.

Advertisement

Global oil prices plunged from $115 to less than $30 per barrel between June 2014 and January 2016, hitting their lowest levels since 2003 amid an ongoing glut in global oil supply.