-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

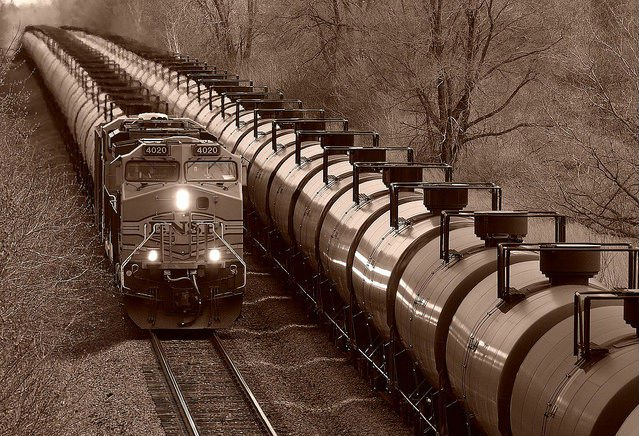

Oil gains, but trades near 4-month lows

After falling to a 12-year low of sub-US$30 a barrel at the start of the year, prices regained ground on supply disruptions such as the Canada’s wildfires in its oil producing regions and rebels bombing supply lines in Nigeria.

Advertisement

International Brent crude futures were trading down 48 cents, or 1.1 percent, at $43.81 per barrel. Inventories of the motor fuel slid by 3.26 million barrels last week, according to data from the Energy Information Administration.

The outlook for lower demand is coupled with record-high crude production expected from OPEC members this month as top exporter Saudi Arabia pumps close to its highest level.

A build up in crude oil inventories in today’s official figures would signal decreasing demand from refiners. U.S. commercial crude oil inventories increased by 1.4 million barrels from the previous week to 522.5 million barrels.

In spite of Wednesday’s gains, US oil prices persist near four month low of $39.19 hit earlier this week.

Oil rebounded after tumbling more than 20% into a bear market, closing below $40 a barrel on Tuesday for the first time since April.

Despite the slightly higher prices early on Tuesday, analysts said that overproduction in crude as well as the refining sector was still weighing on markets.

“We see worrisome trends for supply, demand, refined products, the macro and positioning that may all coalesce in late summer”. Gasoline jumped as much as 1.9 per cent, and was trading 1 per cent higher at US$1.3248 a gallon.

September benchmark contracts fell 55 cents to settle at US$39.51. We believe that this data had a negative impact on the crude oil prices along with the uncertainty about the hike of the interest rate in the US.

Last week the downtrend on the crude oil market was continuing. “However, with CFTC data showing investors increased their shorts positions the most ever for the week ending 26 July, this suggests a short covering rally”, ANZ bank said on Friday.

USA oil stockpiles have decreased since hitting their April peak, but they remain near 30-year highs, and that continues to pressure prices.

Advertisement

Financial oil traders have taken note of the glut, with hedge funds taking on large volumes of bets that would profit from lower prices, known as shorts.