-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

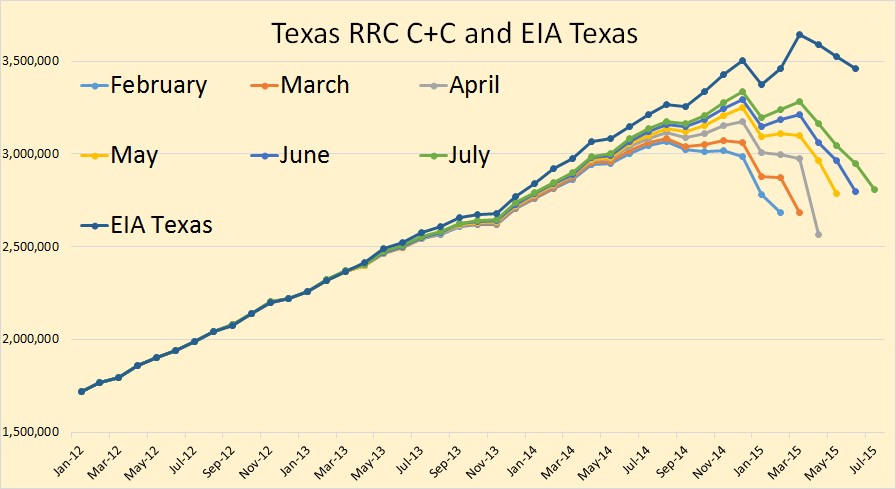

Oil prices rebound amid falling U.S. output

EIA said that USA production will fall by one million barrels per day over the next year and that, “expected crude oil production declines from May 2015 through mid-2016 are largely attributable to unattractive economic returns”.

Advertisement

Reports last week from IEA and EIA paint a bleak picture for oil prices as the world production surplus continues.

Oil prices gained on Wednesday, bouncing back after initially sliding in the wake of disappointing Chinese manufacturing data. “The numbers are pretty much as expected”.

The West Texas Intermediate for October delivery moved down 85 cents to settle at $45.83 a barrel on the New York Mercantile Exchange, while Brent crude for November delivery increased 16 cents to close at $49.08 a barrel on the London ICE Future Exchange.

The U.S. oil price fell on Tuesday as traders anxious that global supplies exceed demand.

While USA output has started to ease, many believe it is not enough to soak up a flood of oil coming from elsewhere.

The preliminary reading of Chinese manufacturing activity compiled by Caixin Media Co. and research firm Markit Ltd. fell to a six-and-a-half year low of 47.0 in September from a final reading of 47.3 in August. Levels below 50 show a contraction.

Many analysts say oil prices could be about to recover, but investors remain anxious about China.

“The data underscores the possibility of a hard landing in China, but the recent declines in USA crude supply are lending some support to market”, said Virendra Chauhan, an oil analyst at Energy Aspects.

Advertisement

Jenny W. Hsu contributed to this article.