-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

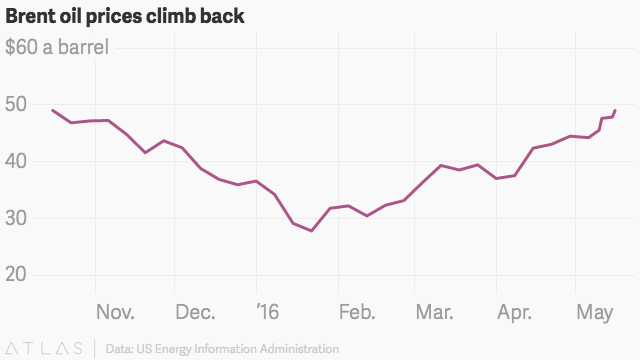

Oil prices remain near 2016 highs on global supply disruptions

“The oil market has gone from nearing storage saturation to being in deficit much earlier than we expected and we are pulling forward our price forecast”, wrote analysts Jeffrey Currie and Damien Courvalin in a note to investors.

Advertisement

Brent LCOc1 settled down 35 cents at $48.93 a barrel.

Oil extended its decline for a second day as USA crude stockpiles unexpectedly increased, keeping supplies at the most in more than eight decades.

Barclays said that “while the supply-side disruptions are supporting oil market balances, refinery margins are starting to weaken, especially in Asia”, adding that weaker demand from those refiners could produce “downside risk to prices in Q3 16”.

Goldman analysts warned the market would return to a surplus in the first half of 2017, as estimated prices around $50/Bbl in the second half of this year would see exploration and production activity pick up.

Brent crude futures LCOc1 rose 0.7 per cent to $49.31 per barrel, after having risen 2.4 percent on Monday, touching $49.47, its highest since early November.

WTI rallied Tuesday to US$48.76 – the highest level since mid-October, 2015.

The U.S. dollar index, which measures the currency’s strength versus a trade-weighted host of 6 other key currencies, moved 0.14 pct to 94.47, which is still not too distant from peaks as of Friday’s close of 94.85, the highest mark since late April this year.

Around 1130 GMT, US benchmark West Texas Intermediate (WTI) for delivery in June was down two cents at $47.70 a barrel.

(GS) said that the oil market is facing a deficit in crude production following production disruptions in Nigeria and Canada.

Oil output from Iran has rebounded strongly since Western sanctions were lifted in January following a deal over its nuclear program.

Stockpiles at Cushing, Oklahoma, the delivery point for WTI and the biggest USA oil-storage hub, increased by 508,000 bbl, the API was said to report.

Here in Canada, the shutdown of oilsands operations because of the Fort McMurray wildfire has also led to a big drop in oil production.

US gasoline stockpiles fell by 2.5 MMbbl last week vs. a draw of 150 Mbbl expected by analysts in a Reuters poll.

Advertisement

According to the Conference Board of Canada, oil production was reduced by 1.2 million barrels per day on average due to the fires. On Tuesday, oil prices set new records for the year, following the report that the resumption of Canadian supplies will take longer than expected.