-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

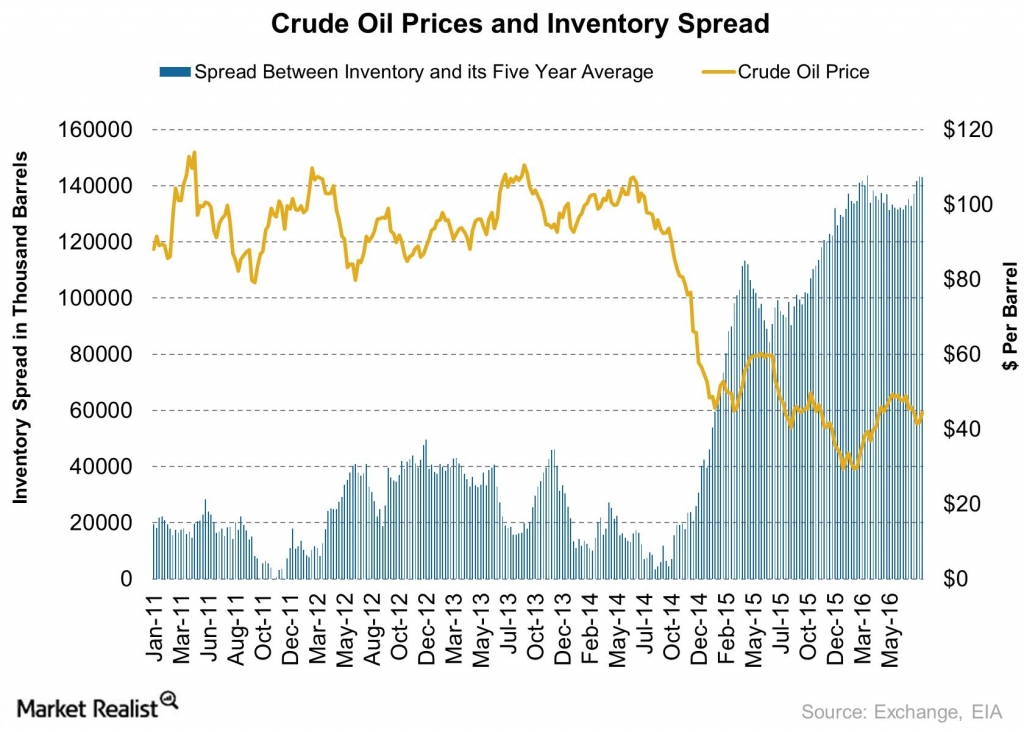

Oil prices slide as dealers eye output talks

Crude prices edged lower on Thursday as brimming USA and Asian fuel inventories returned investors’ attention to a large global supply overhang, cutting short a price rally and restricting Brent crude futures to below the $50 a barrel mark. “The Iranian statement that they will attend the talks in Algiers is helpful”.

Advertisement

USA crude’s West Texas Intermediate (WTI) futures rose 33c, or 0.7%, to $47.1.

FXTM chief market strategist Hussein Sayed said: “Oil market fundamentals have been clearly ignored in August as price action was driven exclusively by verbal interventions; it remains to be seen whether this is going to be converted into actions”. Total volume traded was 25 per cent below the 100-day average. Benchmark Brent crude was trading near $49 a barrel on Thursday in London.

An oil-output freeze by producing countries would be “positive” if it happens because it would indicate that supply and demand are balanced, Al-Falih he said in an interview in Los Angeles at a US-Saudi Arabian Business Council event.

Crude prices edged higher but struggled for clear direction on Thursday as the surprise build in US crude inventories last week disappointed investors and renewed concerns about the oversupplied oil market.

SHANA, the official news agency for the Iranian Oil Ministry, reported Oil Minister Bijan Zanganeh is scheduled to appear in what was described as a “closed-door” meeting on the sidelines of next month’s International Energy Forum in Algeria.

Analysts say strong imports – an increase of 449,000 barrels per day from last week – and slower refining activities were the main drivers behind the increase.

In the United States, commercial crude oil stocks rose by 2.5 million barrels to 523.6 million barrels C-STK-T-EIA, 16 percent higher than a year ago.

Crude futures also saw support from players buying on dips and looking for a bottom on speculation that next month’s informal meeting between OPEC and other major oil producers could result in production curbs.

Advertisement

You have left for this month.