-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Oil prices up in world market

Prices surged Thursday after the Energy Information Administration said US crude supplies fell by 14.5 million barrels last week, the biggest weekly drawdown since 1999.

Advertisement

Moreover, the size of last week’s decline was probably a one-time event, as analysts attributed the draw to a storm that impacted operations along the U.S. Gulf Coast.

U.S. benchmark West Texas Intermediate for October delivery rose $2.12 to $47.62 a barrel.

Operators shut 192,000 b/d of oil production last week as the storm that became Hurricane Hermine moved through the Gulf of Mexico.

Disrupting the normal supply line and adding to the surprise drawdown, Tropical Storm Hermine led to the loss of some production and limited imports and shipping.

Earlier today, oil recovered as market players continued to weigh the odds of a freeze output in the Organization of the Petroleum Exporting Countries (OPEC) conference set later this September in Algeria.

Brent crude, the benchmark for more than half the world’s oil, is projected to average $42.54 this year, a gain from the prior estimate of $41.60.

Despite this decline, United States crude oil inventories are at historically high levels for this time of year, according to the EIA.

Crude imports dropped to 7.07 million barrels a day last week, the biggest decline since September 2012, EIA said.

Comments from OPEC kingpin Saudi Arabia and major producer Russian Federation earlier this week, coupled with Iranian president Hassan Rouhani s commitment to “stabilising the market”, have raised hopes of a possible production cap. Total volume traded was 5% below the 100-day average.

There was also a sharp decline in gasoline inventories on the week, while U.S. crude production declined further by 0.35% to 8.46mn bpd.

London Brent crude for November delivery was down 47 cents at $49.52 a barrel as of 0333 GMT after rising above $50 for the first time in two weeks and settling up $2.01, or 4.2 percent, on Thursday. October delivery of crude oil on the NYMEX, meanwhile, tacked on 0.42% to $45.02 a barrel.

USA refinery utilization rose 0.9 percentage point, compared with analysts’ expectations for a 0.4 percentage point decline.

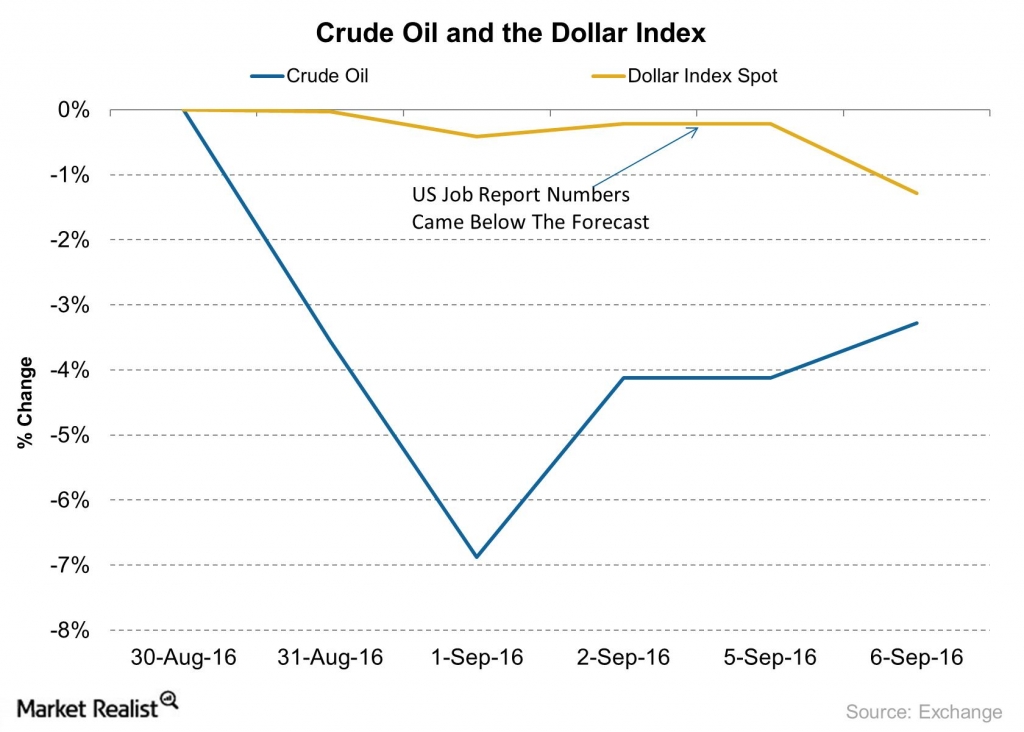

A strengthening dollar also weighed on oil prices Friday. Gasoline inventories fell by 4.2 million barels.

Refineries operated at 93.7 percent of their operable capacity last week.

Advertisement

The Bloomberg Dollar Spot Index, which measures the currency against 10 major peers, fell as much as 0.5%, nearing a two-week low.