-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

OPEC Shifts Blame For Global Supply Glut

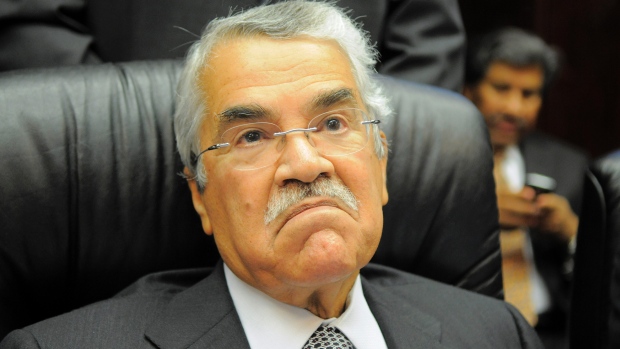

Ali al-Naimi said production cuts by big, low-priced producers such as Saudi Arabia would amount to subsidizing higher-cost ones – an apparent reference to USA shale-oil drillers.

Advertisement

Oil prices slid further on Wednesday after Saudi Arabia dismissed the possibility of a production cut and traders expected another increase in US oil stockpiles.

Oil tumbled after the Iranian Oil Minister said that an agreement by Saudi Arabia and Russian Federation last week for oil producers to freeze output was “ridiculous”. According to a report from Iran’s student news agency ISNA, the country’s oil minister said the production freeze is “laughable”, because it does not allow Iran to regain its production share.

Addressing the annual IHS CERAWeek conference in Houston, Naimi told global energy executives that growing support for the freeze and stronger demand should over time ease a global glut that has pushed oil prices to their lowest levels in more than a decade.

Al-Naimi rejected the idea of an OPEC production cut, saying they won’t work to boost oil prices. “Yet, the latest development seems to suggest that for oil producers to get more united they will have to feel more pain”, said Ayako Sera, senior market economist at Sumitomo Mitsui Trust Bank.

Considering al-Naimi helped start the oil crash, those comments can’t inspire much confidence in the short term.

As of 17:45GMT prompt-month crude oil futures were down by 4.174% to $33.30 per barrel on the ICE while West Texas Intermediate was 4.9% lower to $31.83.

He also said that a proposed freeze in output at January levels, which were near record highs, would require “all the major producers to agree not to add additional barrels”.

Talks of a joint production hold is due to the drop in price the commodity has undertaken since 2014, losing almost 70 percent of value.

With crude prices collapsing further this year, Saudi Arabia wants global oil producers to team up.

“I suspect few people were expecting a deal to cut production so his comments are hardly a surprise”.

“We’re all in it together”, al-Naimi said.

“U.S. shale output is going to decline”, said Sarah Emerson, managing director of ESAI Energy Inc., a consulting company in Wakefield, Massachusetts. US production has slowed, but remained near all-time highs at the end of 2015.

Advertisement

This chart from the International Energy Agency shows Canada and the US are among the most expensive places to launch oil extraction projects.