-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

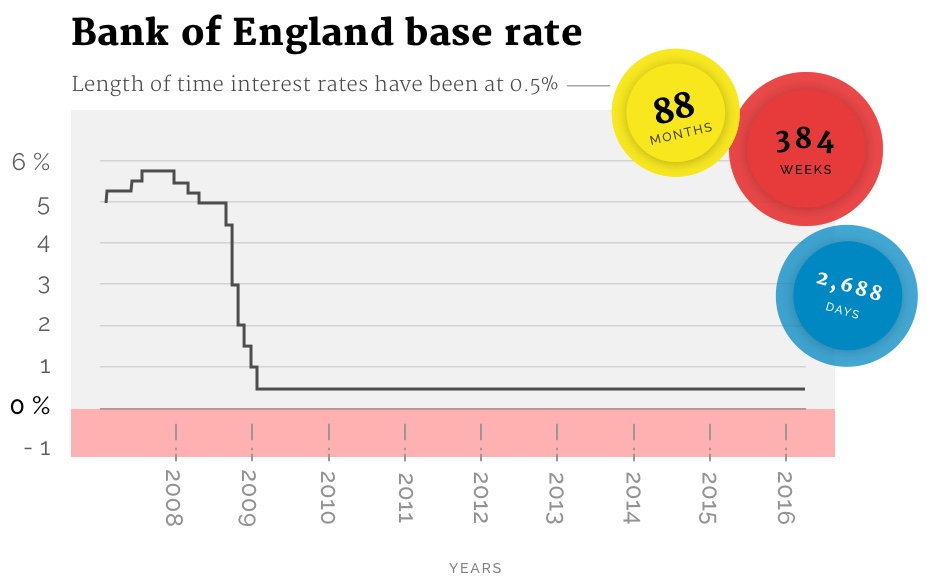

Pound jumps after Bank of England opts against rate cut

Markets were surprised today when the Bank of England announced that it would be keeping its Base Rate of 0.50% and Asset Purchase Facility of 375 billion pounds unchanged. It was also stated that the “precise size and nature” of that stimulus would be determined based on the revised economic projections in the August Inflation Report.

Advertisement

Bank of England governor Mark Carney has paved the way for a possible cut by making a series of statements since the referendum.

Governor Mark Carney sent a clear signal two weeks ago that stimulus was on the way in an attempt to show the economy was in safe hands while the country’s political leadership crumbled after the European Union vote.

Jeremy Stretch, an FX strategist at CIBC capital markets, has suggested there is pressure on the BOE to follow-through with Carney’s pledge to cut interest rates at his June 30 speech. She said: “It is positive to see that the Bank of England has chose to hold interest rates at 0.5% as a sign of confidence in the post-Brexit UK economy”.

But only one member of the bank’s Monetary Policy Committee, Gertjan Vlieghe, voted to cut interest rates to 0.25 per cent.

We’ll be tracking the build-up to the big decision, and instant reaction and analysis from noon.

Although unlikely at this meeting, restarting the quantitative easing program, which now stands at £375 billion could be on the table, and a combination of a rate cut along with new QE program has the potential to pull back GBPUSD below 1.3.

Sterling rose to a two-week high of Dollars 1.3480 on the news, while the global focused benchmark FTSE 100 trimmed some of its gains.

Essentially, the bank has behaved cautiously, preferring to wait until more economic data is available before making any major monetary shifts.

All European stock indices dipped immediately after the BOE announcement, losing their gains earlier in the day. It slid back into negative territory after the bank held rates, before edging higher again.

Officials said they expect the economy to weaken in the coming months, flagging evidence of slowing business investment and falling consumer confidence.

Crude oil prices continued a stretch of high volatility Thursday, moving up almost 2 percent in early trading on signs of British economic optimism.

Expect the markets to move sharply at noon – especially if the Bank does something unexpected.

Advertisement

Data released early on Thursday showed interest among buyers in Britain’s housing market tumbled to its lowest level since mid-2008, adding to early signs of the Brexit hit to the economy. First, a slowdown in economic growth following the referendum vote, which many economists believe could tip the economy into recession.