-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Pvg Asset Management Lowers stake in Independence Realty Trust Inc (IRT)

We make no recommendation that the securities of the companies profiled or discussed in on our website should be purchased, sold or held by investors. Cedar Realty Trust Inc (NYSE:CDR) has risen 10.15% since January 25, 2016 and is uptrending.

Advertisement

A number of FactSet analysts shared their views about the current stock momentum. The most bullish price estimate of the stock is set at $33 while the bearish estimate is kept at $30 over the next one year.

On the company’s financial health, Digital Realty Trust reported $1.42 EPS for the quarter, beating the analyst consensus estimate by $ 0.03 according to the earnings call on Jul 28, 2016.

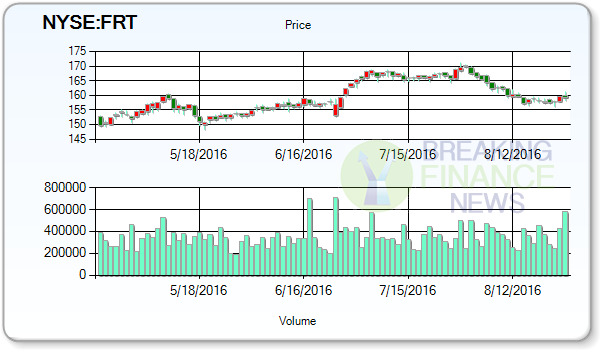

With a total market value of $11.4B, Federal Realty Investment Trust has a 52 week low of $125.09 and a one-year high of $171.08 with a PE ratio of 44.

Arbor Realty Trust Inc.is a real estate finance company. This number is based on the average of 11 ratings given by sell-side analysts. Now shares have been rated as “Buy” from 2 Analysts.

Prologis, Inc.’s (PLD) has YTD performance of 26.17%.

The stock has also started to move higher lately, adding 128.7% over the past four weeks, suggesting that investors are starting to take note of this impressive story.

Federal Realty Investment Trust is an equity real estate investment trust (REIT) engaged in the ownership, management, and redevelopment of retail and mixed-use properties. Empire State Realty Trust, Inc. has an EPS ratio of 0.31. The Company’s Core Portfolio consists primarily of street retail and urban assets, as well as suburban properties located in various trade areas. Company shares were Reiterated by Barclays on Aug 12, 2016 to “Overweight”, Firm has raised the Price Target to $ 126 from a previous price target of $118.Company shares were Reiterated by RBC Capital Mkts on Aug 4, 2016 to “Outperform”, Firm has raised the Price Target to $ 120 from a previous price target of $105.Digital Realty Trust was Downgraded by Jefferies to ” Hold” on Jul 19, 2016.

During the 52-week period, the peak price level of the share was observed at $21.27; this is higher price of share and down price level of the share was seen at $14.58; this is lower price at which share is traded. The Company conducts its business through, and its interests in properties are held by, Vornado Realty L.P. The average forecast of sales for the year ending Dec 16 is $414.18M by 4 analysts. Recently, analysts have updated the mean rating to 1.8. On a recommendation scale of one to five where a one constitutes a Strong Buy and a five constitutes a Strong Sell, Physicians Realty Trust (NYSE:DOC) has a rating of 1.78.

Advertisement

The share price of Independence Realty Trust, Inc. The Company’s Core Portfolio includes approximately 90 operating properties, totaling over 5.6 million square feet of gross leasable area (GLA).