-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

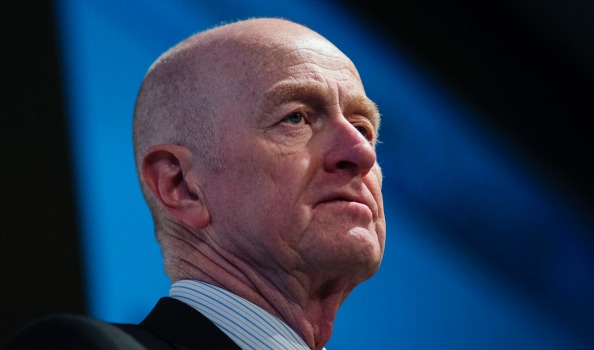

RBA keeps cash rate on hold at 2% — News Item

Although an interest rate cut would have been nice for dividend investors, it’s actually encouraging that the Board elected to leave them unchanged in that it does not believe a rate cut is necessary in light of the Greek situation.

Advertisement

The Australian dollar is a “high-yielding” currency and is therefore susceptible to sell-offs in risky environments such as that generated by Greece.

But Australian consumers are clearly anxious that events in Greece and China will flow through to the Australian economy. However, there has been some good news as Australia’s labor market has shown signs of recovery, with the jobless rate falling to a 12-month low of 6% in June.

HSBC Australia chief economist Paul Bloxham said the RBA is in a “wait and see” mode, assessing the impact of rate cuts before making further moves.

There was nothing new on house prices although the bank continues to think Sydney property prices are the only hot spot.

This would be the first step to halting the extraordinary price growth that Sydney and Melbourne have experienced in the past three years, which has shut out most first timers.

NAB chief markets economist Ivan Colhoun said the RBA’s comments on the jobs market were better than what it had previously said.

Construction activity has continued to contract as the fall in mining-related projects overshadows expansion in the housing sector.

The bank noted key commodity prices have been weak but puts this down to increasing supply. This trend appears largely to reflect increased supply, including from Australia. Hence, global financial conditions remain very accommodative.

THE kiwi was little changed at 66.61 United States cents at 5pm in Wellington from 66.84 cents at 8am and 66.71 cents on Monday. “Overall, the economy is likely to be operating with a degree of spare capacity for some time yet”, said Stevens.

Mr Tedder said there is a chance the Australian dollar could establish itself back above 75 United States cents.

Advertisement

“We continue to expect the exchange rate to drop towards the AUD/USD 0.70 mark”, says a morning brief from Intessa Sanpaolo.