-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

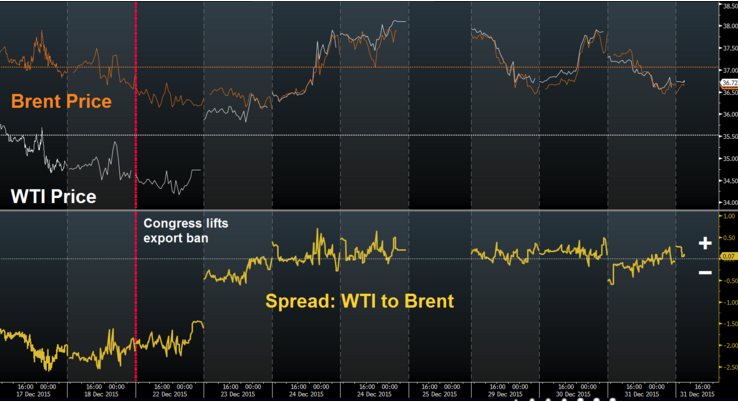

Renewed Oil Slump Weigh on the Global Equity Markets

Daniel Ang, an investment analyst with Phillip Futures in Singapore, said the price weakness could also have been sparked by data showing Japanese industrial production fell 1.0 percent in November from a month earlier. Concerns earlier in the year that Cushing could run out of room to store oil weighed heavily on prices. Crude inventories in the United States rose 2.6 million barrels last week, the U.S. Energy Information Administration said.

Advertisement

The American Petroleum Institute, an industry group, on Tuesday reported a surprise build in United States stocks.

“We should get another draw in oil inventories tomorrow”, said Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $3.4 billion in assets.

US stores of oil generally grow in the fall and the spring when refineries slow their processing in order to do maintenance.

Disputes between Iran and rival Saudi Arabia have sparked disunity among OPEC’s 13 members, which issued only vague references to production levels after its last regular meeting in early December.

Oil prices have collapsed 30% so far this year, to levels not seen since the global financial crisis. Many analysts and firms had expected a decline. They slid more in the NY session, as some traders reckoned the two-day pre-Christmas rebound, where crude rose about $US2 ($F4.26) a barrel, had been overdone.

Amid global oversupply, world oil prices have continued to plummet, with Brent crude reaching an 11-year low in December. The downturn has caused pain across the energy supply chain, including shippers, private oil drillers and oil-dependent countries from Venezuela and Russian Federation to the Middle East. Analysts estimate global crude production exceeds demand by anywhere between half a million and 2 million barrels every day.

On the last trading day of 2015 for European bond markets, 10-year German Bund yields were flat at 0.63 percent and up almost 10 basis points on the year. The Energy Minister of Saudi Arabia believes that the country’s unrestrained output is reliable and required.

Oil prices had surged around 3% in the previous session as the prospect of colder weather in North America elevated expectation for stronger demand for heating fuels.

Advertisement

Despite the oil price slump, Iran has vowed to ramp up crude oil production and reclaim its lost share of exports shortly after worldwide sanctions are lifted, expected in January 2016.