-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

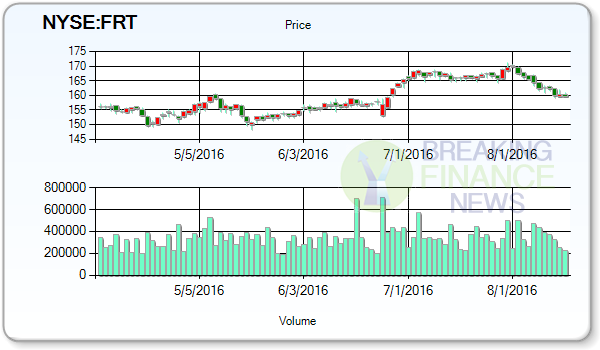

Revenue Update on Federal Realty Investment Trust(NYSE:FRT)

(NYSE:DLR) closed 17.94% above its 200-day moving average which many technicians use as a guide to the long-term trend, so stocks above the line are considered to be in longer-term uptrends, while those below it are considered to be in downtrends. Federal Realty Investment Trust’s revenue was up 8.9% compared to the same quarter past year. Calculating estimated earnings after taking into consideration different elements, it is predicted to come at $1.580 for the next fiscal and $N/A for underway quarter. They now have a United States dollars 18 price target on the stock. The 52-week high of the shares is $171.08 while the 52-week low is $124.87.

Advertisement

Federal Realty Investment Trust (NYSE:FRT) last posted its quarterly earnings results on Thursday, August 4th. This ratio, which is also called as the P/E ratio evaluates the company on relative expense factor.

The business also recently disclosed a quarterly dividend, which will be paid on Monday, October 17th. Investors of record on Thursday, September 22nd will be issued a $0.98 dividend.

Piedmont Office Realty Trust, Inc. had its “neutral” rating reiterated by analysts at D.A. Davidson. This represents a $3.92 dividend on an annualized basis and a dividend yield of 2.49%. The Hedge Fund company now holds 18,000 shares of QTS which is valued at $981,360. (Piedmont) is an integrated self-managed real estate investment trust specializing in the acquisition, ownership, management, development and disposition of primarily Class A office buildings located in the United States office markets. The net profit margin for Digital Realty Trust Inc. stands at 3.40%.

05/10/2016 – Piedmont Office Realty Trust, Inc. had its “sell” rating reiterated by analysts at Stifel Nicolaus.

Thomson Reuters, a distinguished brokerage company, has placed a 52-week price target of $40.580 on Acadia Realty Trust (NYSE:AKR) shares after it surveyed top market analysts. Canaccord Genuity increased their target price on shares of Federal Realty Investment Trust from $167.00 to $180.00 and gave the company a “buy” rating in a research note on Tuesday. Piedmont OP owns properties directly, through subsidiaries, and through both consolidated and unconsolidated joint ventures.

Advertisement

10/16/2015 – American Assets Trust, Inc. had its “overweight” rating reiterated by analysts at Morgan Stanley. RBC Capital Markets reaffirmed an “underperform” rating and issued a $140.00 price objective (up previously from $130.00) on shares of Federal Realty Investment Trust in a research note on Wednesday, August 10th. They issued a “hold” rating and a $160.00 price target for the company. Two research analysts have rated the stock with a sell rating, eleven have assigned a hold rating and three have issued a buy rating to the company’s stock. The formula to calculate ratio is stock’s latest price/ per share earnings. As of December 31 2014 the Company owned or had a majority interest in community and neighborhood shopping centers and mixed-use properties which are operated as 89 retail real estate projects comprising approximately 20.2 million square feet.