-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

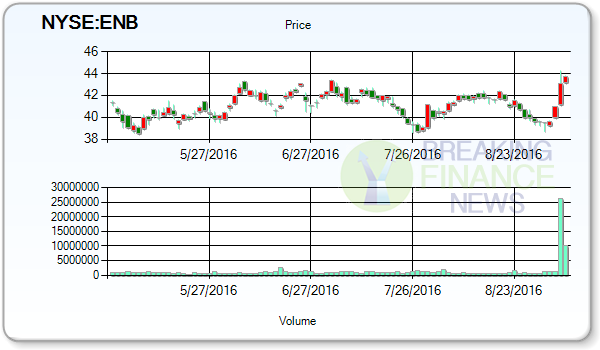

Reviewing Hot Stock of Yesterday- Spectra Energy Corp.’s (SE)

Currently, Spectra Energy carries a Zacks Rank #3 (Hold) while Enbridge holds a Zacks Rank #2 (Buy). Finally, Mitsubishi UFJ Financial Group initiated coverage on shares of Spectra Energy Partners, in a research note on Thursday, July 21st. The highest analyst price target is $42.00, which implies a gain of 100 percent.

Advertisement

The merged company brings a low-risk commercial structure with stable long-term cash flow, as 96% of pro-forma free cash flow is underpinned by long-term commercial agreements (cost-of-service, take-or-pay, of fixed fee); 93% of customers are investment grade or equivalent counterparties; and less than 5% of combined pro-forma cash flow will have direct exposure to commodity price risk. Spectra Energy Corp. has been the topic of 10 analyst reports since September 10, 2015 according to StockzIntelligence Inc. Seven analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. The stock has a 50 day moving average price of $47.13 and a 200-day moving average price of $47.08. The stock stands almost -8.13% off versus the 52-week high and 90.28% away from the 52-week low. The combined companies will have about $46 billion in debt.

This story is the sole property of American Banking News and it was originally published by American Banking News. Spectra Energy reported actual earnings last quarter of 0.24 which fails to beat the.27 consensus estimate, a -11.10% surprise.

These analysts also forecasted Growth Estimates for the Current Quarter for SE to be 21.7%. For the reporting quarter, equity analysts expect the stock to deliver $0.28 in earnings per share (EPS). The company had revenue of $618 million for the quarter, compared to analysts’ expectations of $645.60 million.

The company also recently disclosed a quarterly dividend, which was paid on Friday, August 26th.

Enbridge anticipates a 15% annualized dividend increase in 2017. Several arrests were made last week at a site in North Dakota where Energy Transfer Partners is trying to build a line to IL. It has a dividend yield of 3.86%.

The increase in Canadian outbound deals has in the recent past been primarily driven by the country’s pension funds and money managers buying overseas, he said. The performance this quarter is at 24.55% while the weekly performance is at 14.75%.

The growth in outbound transactions by Canadian companies, including those in energy, comes from a combination of low interest rates, a need to find growth outside of the low-growth Canadian economy, and several corporate buyers calling a bottom in the commodity cycle, according to John Emanoilidis, a partner and co-head of the M&A practice at Torys in Toronto. The company’s 5 year Earnings per share growth and Capital Spending growth remains at -28.89 and 16.17. Finally, Sanford C. Bernstein assumed coverage on shares of Spectra Energy Partners, in a report on Wednesday, May 11th.

Advertisement

“The environmentalists are out there, they’re powerful, and they’re trying to stop the natural gas pipelines”, said Jay Hatfield, chief executive officer of Infrastructure Capital Management LLC, a New York-based hedge fund.