-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Square Discounts Stock to $9 a Share

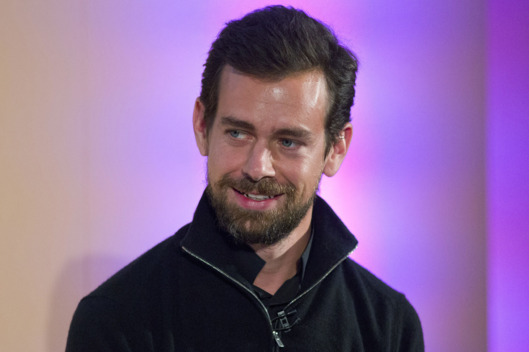

Square CEO Jack Dorsey gets a birthday kiss from his mother, Marcia Dorsey, before his company’s IPO at the NY Stock Exchange on Thursday.

Advertisement

The stock reached $14.78 at one point in the early hours of trading.

The unusual decision to price its shares at a level below the that of its most recent private funding round effectively halved the valuation of the company from $6bn in October past year, when it sold shares at $15.50, to less than $3bn. The company priced the offering of 27,000,000 shares of its Class A common stock at a public offering price of $9.00 per share.

A number of tech IPOs have performed poorly over the past year, and mutual fund investors including Fidelity Investments have been marking down the value of their private tech holdings. The theory is that many of those companies will stumble when they’re forced to move past the hype and have to become profitable, publicly traded businesses. Only previous year, private investors have valued the company at $6 billion.

Square’s IPO was a long time coming.

The opening price was just $.20 higher than the minimum price originally proposed by the company a few weeks ago.

But it is certainly the most high-profile company to do so.

Within minutes of its Wall Street debut, shares of Square (SQ) were trading above $13 per share, a 40 percent pop over its initial offering price of $9.

The sale has been seen as a key test for unicorns including Airbnb, Snapchat and Uber, which have raised billions in private financing that they will one day need to repay via share sales.

It happened. Square has filed for its long-awaited IPO, and in doing so gave a small glimpse at the company’s path forward.

“Square had this very unique proposition of allowing anybody to accept credit cards”, says Gil Luria, analyst with Wedbush Securities, who recalls Square’s glory days: “It was a very novel idea”.

Square, which has been investing heavily, reported a loss of US$131.5 million in the first nine months of the year after losing US$117 million a year earlier, but revenue rose 49 per cent to US$892.8 million.

Sharing Square’s IPO spotlight Thursday is the Match Group, parent company to online dating firms Tinder, OkCupid and Match.com.

Advertisement

Everyone is crowing about the collapse of Square’s valuation and how the late stage investors who valued the company at $6 billion are dumb.