-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

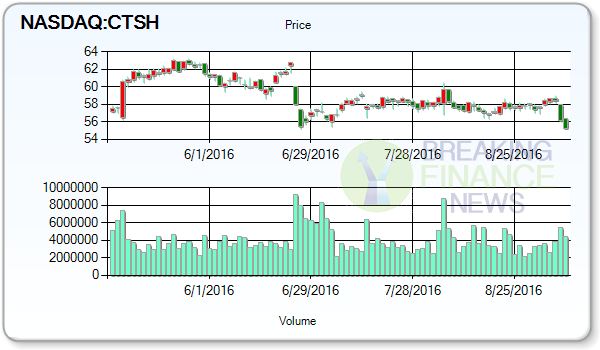

Stock In Limelight: Cognizant Technology Solutions Corporation (NASDAQ:CTSH)

Over the same time span, the stock notched a high price of US$120.02 and its minimum level reached was US$91.57. The company’s institutional ownership is monitored at 77.4%.

Advertisement

01/14/2016 – Cognizant Technology Solutions Corporation had its “outperform” rating reiterated by analysts at BMO Capital Markets. Wedbush Initiated Cognizant Technology Solutions Corp on Sep 9, 2016 to “Neutral”, Price Target of the shares are set at $65.Cognizant Technology Solutions Corp was Downgraded by Nomura to ” Neutral” on Aug 8, 2016. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Equities analysts predict that Cognizant Technology Solutions Corp. will post $3.38 EPS for the current fiscal year.

Investors evaluating CTSH stock at the current market price of $56.4/share should know the company will next release quarterly results for the September 2016 quarter.

The stock price demonstrated downbeat change from its 50 day moving average of 57.67 and had been down from its 200 Day Moving Average of 59.13.

Taking notice on volatility measures, price volatility of stock was 1.79% for a week and 1.57% for a month. Analysts have a mean recommendation of 1.80 on this stock (A rating of less than 2 means buy, “hold” within the 3 range, “sell” within the 4 range, and “strong sell” within the 5 range).

Cognizant Technology Solutions Corp opened for trading at $55.17 and hit $56.52 on the upside on Monday, eventually ending the session at $56.4, with a gain of 2.12% or 1.17 points.

Glancing over stock’s performance with EPS trend, the current quarter estimates trends for EPS by pool of analysts was $0.84 and for one month ago was $0.84, as Q1 2017 Trends estimate stands at $0.86, according to WSJ analytic reports. That compares with the mean forecast $3.37B and $0.82/share, respectively. The company’s revenue was up 9.2% compared to the same quarter a year ago. Also, CEO Francisco Dsouza sold 100,000 shares of the firm’s stock in a transaction dated Tuesday, July 26th. 4 rated the company as a “Hold”. Following the transaction, the chief executive officer now directly owns 422,602 shares in the company, valued at approximately $24,751,799.14. Exane Derivatives now owns 1,862 shares of the information technology service provider’s stock worth $117,000 after buying an additional 419 shares during the last quarter.

During last 5 trades the stock sticks nearly -2.23%. Finally, Duncker Streett & Co.

07/25/2016 – Cognizant Technology Solutions Corporation had its “buy” rating reiterated by analysts at Jefferies. Inc. increased its position in shares of Cognizant Technology Solutions Corp.by 5.0% in the second quarter.

Advertisement

About Cognizant: Cognizant (NASDAQ: CTSH) is a leading provider of information technology, consulting, and business process services, dedicated to helping the world’s leading companies build stronger businesses. The Company operates in four segments: Financial Services segment, which include banking and insurance; Healthcare segment, which includes healthcare and life sciences, and Manufacturing/Retail/Logistics segment, which includes manufacturing and logistics; retail, travel and hospitality, and consumer goods and Other segment, which includes Communications, Manufacturing/Retail/Logistics, and High Technology.