-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

Stocks tumble as weaker forecast sends oil prices lower

Wall Street dropped with the price of oil after reports from OPEC and the International Energy Association showed that the global glut wont abate any time soon. “Unexpected gains in Europe have vanished, while momentum in the US has slowed dramatically”.

Advertisement

U.S. West Texas Intermediate futures were down 80 cents, or 1.74 percent, at $45.08 a barrel.

The Dow Jones industrial average was down 224.83 points, or 1.23 percent, to 18,100.24, the S&P 500 had lost 29.08 points, or 1.35 percent, to 2,129.96 and the Nasdaq Composite had dropped 57.53 points, or 1.1 percent, to 5,154.36.

Yields in German and Japan also rose as the selling in bond markets continued, despite moves by central banks in several countries to step up their purchases of corporate bonds as part of their quantitative easing programs.

To add gloom, the IEA also said that demand growth will further slacken to 1.2 million bpd next year, citing “uncertain” macroeconomic conditions.

The Standard & Poor’s 500 index declined 32 points, or 1.5 percent, to 2,127.

The International Energy Agency (IEA), which advises oil-consuming countries on their energy policies, said a sharp slowdown in oil demand growth, coupled with ballooning inventories and rising supply, means the market will be oversupplied at least through the first half of 2017.

The IEA, which represents 29 oil-producing countries, is predicting slower growth in demand for oil because of a more pronounced economic slowdown during the third quarter of the year, among other factors.

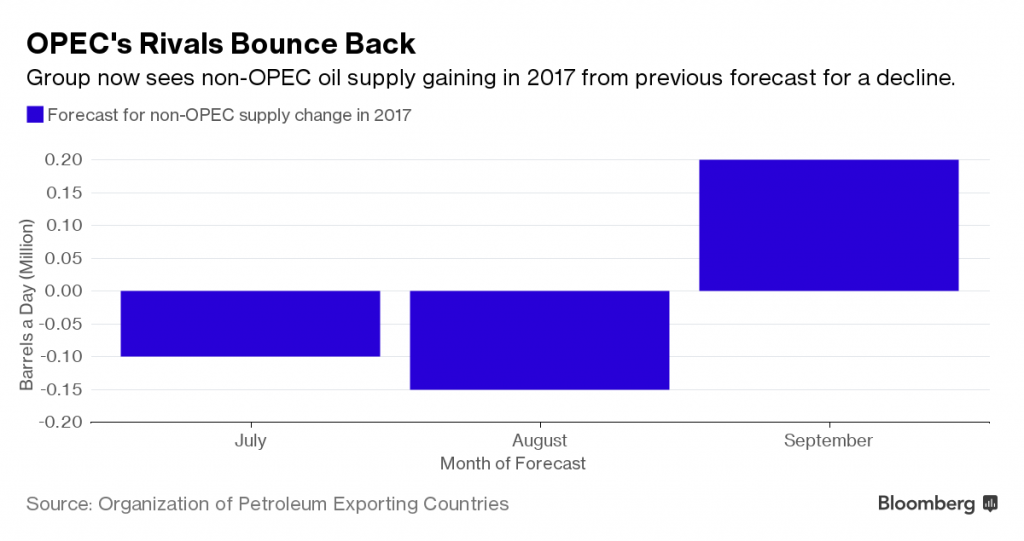

Traders said the price falls on Tuesday were an indication that increasing oil drilling activity in the United States was still a concern even as crude prices closed higher on Monday because of a weaker dollar. The revision was prompted by a faster-than-expected waning in demand growth over the third quarter of the year. While a meeting in Algiers by OPEC members is scheduled for later this month, many market watchers are skeptical over the prospect of a cap on production levels.

Bond prices rose. The yield on the 10-year Treasury note fell to 1.66 percent.

World oil prices slumped on Tuesday as the International Energy Agency warned that a global supply glut would last six months longer than thought. Brent crude, the worldwide standard, fell $1.22, or 2.5 percent, to $47.10 a barrel in London. The Australian 10 year yield rose 0.02 points yesterday to 2.06%.

Futures rose during NY trading on Monday (http://www.marketwatch.com/story/oil-prices-stumble-after-rising-baker-hughes-rig-count-2016-09-12), getting a lift from a report from data provider Genscape Inc. that showed storage in tanks in the Cushing, Okla., storage hub fell by more than 1.2 million barrels last week.

Advertisement

“Producers and service companies. are well positioned to return to growth mode at much lower prices”, Barclays said. The dollar was steady at 101.860 yen after shedding 0.8 percent overnight. The FTSE 100 index of leading British shares was down 0.3 percent.