-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

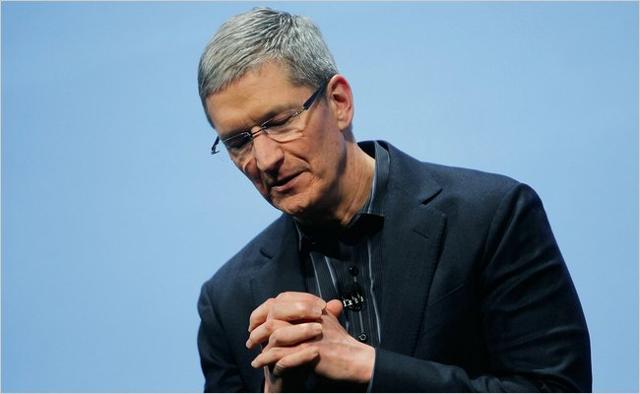

Tim Cook on European Union tax ruling: ‘It is total political crap’

Apple chief executive Tim Cook says the European Commission ruling that Apple should pay €13 billion over its tax arrangements in Ireland is “total political crap” and “maddening”.

Advertisement

In a separate interview on Thursday with Irish state broadcaster RTE, Cook said the European Union decision was “maddening” and that he was very confident his appeal would succeed.

“When you’re accused of doing something so foreign to your values it brings out an outrage in you”, he said.

Cook said Apple had paid $800 million in taxes in 2014 on profits, split roughly between Ireland and the U.S. It’s unclear also whether moving those profits back to the U.S. would reduce its Irish taxes.

Cook added, he would “love” to see the Irish government appeal against the commission’s ruling to pay 13 billion in back tax to the Irish government. Both Apple and Ireland have said that they will appeal the ruling.

It says Ireland must now recover the unpaid taxes in Ireland from Apple for the years 2003 to 2014 of up to €13 billion, plus interest. “We believe that makes us the highest taxpayer in Ireland that year”, he said. The commission ruled that the company had received illegal state aid through its tax agreement with Ireland. Ireland has said they plan to appeal the Commission’s ruling and Apple will do the same. Tax breaks from Luxembourg for Amazon.com Inc. and McDonald’s Corp. are also under investigation.

“Apple has more subsidiaries in Ireland, as indicated in the Commission’s decision to open an investigation”.

The case may take as much as five years before it is completely settled, Dublin law firm McCann FitzGerald said in a report. “This is due to Apple’s decision to record all sales in Ireland rather than in the countries where the products were sold”, the commission said in a statement on Tuesday. “I think we’ll work very closely together, as we have the same motivation”.

The EC has said that the payments were avoided as part of a subsidy for Apple from the Irish government, provided as an inducement to persuade the company to invest in the country. The head office has no base location anywhere and this resulted in their profits staying untaxed for years which greatly lowered their effective tax rate. “I think it’s a desire to reallocate taxes that should be paid in the U.S.to the European Union”.

Advertisement

Apple holds almost $215 billion in cash and securities outside the US, much of that generated by its Irish subsidiaries.