-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

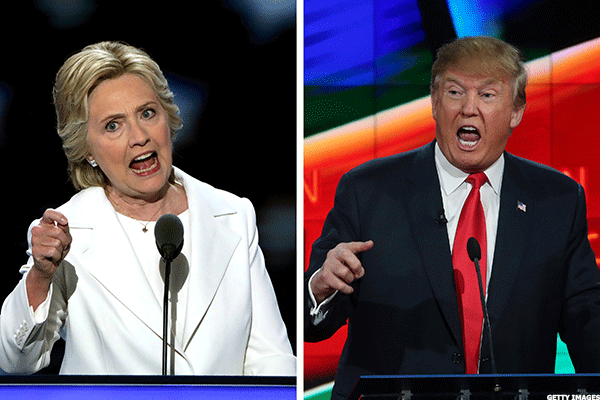

Trump plans would increase debt 26 TIMES more than Clinton’s

The report finds that Trump’s plan would result in an overall reduction in non-interest federal spending (that is, all government outlays not spent servicing US debts) by about $1.2 trillion over the next decade.

Advertisement

The latest changes are part of a series of tax increases Mrs. Clinton has rolled out to pay for targeted tax cuts and for increased spending.

The reduced cost of Trump’s policy plans come from updated with new tax overhauls, child care policies and spending cuts, the Washington-based group said in its analysis, which also estimated that Clinton’s policies would add $200 billion to USA debt, down from a previous estimate of $250 billion.

Although Trump “has made substantial improvements to his plan”, it would still add significantly to the national debt, the report says.

The analysis, CRFB said, includes changes to Clinton’s plans not yet released on her campaign’s website, including a tax on inherited capital gains and an estate-tax range aligned with Sen. “Clinton’s tax policies result in a net increase of $1.55 trillion in revenue over the next decade, including $1.05 trillion from increased taxes on high earners and $150 billion in increased business taxes.Trump, on the other hand, would end up adding another $4.5 trillion to the nation’s debt – incurring revenue losses from $1.45 trillion from individual tax reform, $2.85 trillion from business tax reform, and $1.2 trillion from repealing taxes imposed by the Affordable Care Act”. That figure is less than half the $11.5 trillion that the group estimated for his original plan. On Sept. 15, a Trump campaign adviser told the Tax Foundation that a key provision of Trump’s plan – a 15 percent tax rate for certain types of businesses – would apply only to corporations. Under current law, a 40 percent tax rate applies only to estates worth more than $5.45 million.

The shrunken version of the estate and gift tax that has been in place in recent years brings in relatively little money for the federal government, less than 1% of projected revenue over the next decade, according to the Congressional Budget Office.

Clinton will also propose limiting the tax benefits of so-called “like-kind exchanges”, which will affect investors in real estate, art and other properties.

Clinton’s new spending proposals largely pay for themselves, the report says, and add “modestly” to the national debt – now more than $14 trillion owed by the public, or almost 77 percent of gross domestic product, which is projected to rise to 86 percent of GDP in 2026. It would still reach 86 percent of GDP by 2026.

Advertisement

Clinton’s plan, in contrast, would increase federal spending by about $1.65 trillion over the next decade.