-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

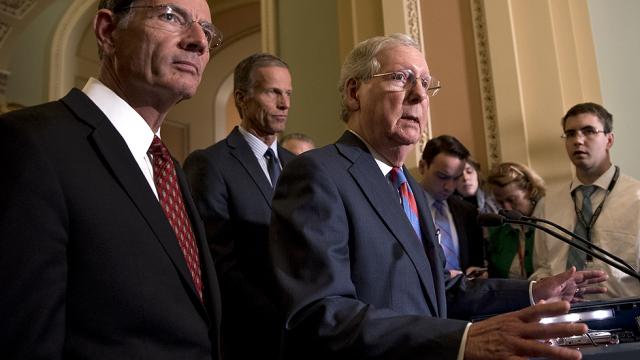

Trump’s tax cuts look vague and timid

There should be no tax cuts for “the rich” until the president releases his tax returns (“Trump, GOP outline proposal to lower, simplify taxes”, September 27).

Advertisement

It also includes a one-time, low tax rate on wealth already accumulated overseas to remove incentives to keep money offshore rather than repatriating it, with the New York Times reporting that as much as US$2.6 trillion in such profits sits in offshore subsidiaries of USA corporations. “People are just risk-averse”. The highest and low-end earners also get a cut in the draft plan, yet the bean counters on Capitol Hill seem to want the plan to resemble a “revenue neutral” tax reform plan – not a tax cut plan.

Taxes on our businesses are also targeted for reform.

In both 07055 in Passaic and 08401 in Atlantic City, the total deduction for state and local taxes represented more than 40 percent of the adjusted gross income in those areas.

Lawmakers have a tricky task ahead to write detailed legislation without alienating members, who will be under intense pressure from constituents and lobbyists to preserve cherished tax breaks.

The plans are far from detailed, however, says The Guardian’s Sabrina Siddiqui.

Republicans are more positive about the plan’s impact.

Tax writers say they plan to offset massive tax rate cuts for individuals and businesses by eliminating scores of deductions and credits that litter the tax code.

Will the Republicans’ tax cuts make up for the loss of these deductions?

As President Trump begins a barn-storming tour to tout his tax plan, we’ve released a short video rebutting some of the most common Republican myths about corporate tax cuts. The high-tax states, however, tend to be Democratic-leaning, such as California and NY, and of the seven states with no income tax of their own, six are Republican-leaning.

The United States corporate income tax rate is more than 10 points higher than China’s, according to the Congressional Budget Office (CBO).

Under the current tax code, Americans can deduct either the income taxes they pay to state and local governments, or the state and local sales taxes they paid throughout the year. Paul is playing his role as a legislator to push hard to make sure that taxes are not hiked on any American in a final draft of a bill.

We are well aware that anti-tax advocates will cry foul and claim the rich deserve a bigger tax cut because they pay more in taxes (as they should since they earn far more than average).

Immediate expensing lets companies take a tax deduction for the full value of new plant and equipment upon purchase, rather than stringing out deductions over several years under accelerated or normal depreciation schedules.

Many Republicans from high-tax states such as New York, California and IL say they’re comfortable getting rid of a tax break for the rich, especially when the rich are Democrats. That was a missed opportunity to simplify the tax code.

“It is bad public policy”, said Rep. Devin Nunes, R-Calif.

Gesturing to the sun-splashed Capitol behind him, Ellison said the rich and corporations “want to take the money and use it to buy more politicians in the building behind you”. I’m not the party of the rich. But they have publicly identified only a few provisions they want to repeal. In 2018, all income groups would see their average taxes fall, but some taxpayers in each group would face tax increases. Chained CPI, on the other hand, is saying, “Instead of indexing the cost-of-living increases to changes in earnings, we will index them to changes in the cost of consumption” and, in general, that is less than earnings inflation. There are a dozen more references to simplification throughout the rest of the document. However, home-owning middle-class families in California could get hammered. In addition to offering benefits to those who invest, carry out research, and create jobs, higher taxes on land and real-estate speculation would redirect capital toward productivity-enhancing spending – the key to long-term improvement in living standards.

“Under our plan”, he said, “95 percent of Americans will be able to file their tax returns on a single page without having to keep receipts, fill out schedules, or track endless paperwork”. The Framework calls for both of these numbers to rise, but it leaves how high to the tax writing committees and the Congress. Senator Paul can not possibly know if middle class families with kids are getting squeezed if he doesn’t know how big the child tax credit will be, nor to whom it will be available. “I’d like to double it, but a lot of it will depend on what we have space for”.

In an editorial published on Breitbart News, Sen.

Advertisement

Unfortunately, this position introduces a deadly one-way ratchet into tax policy.