-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

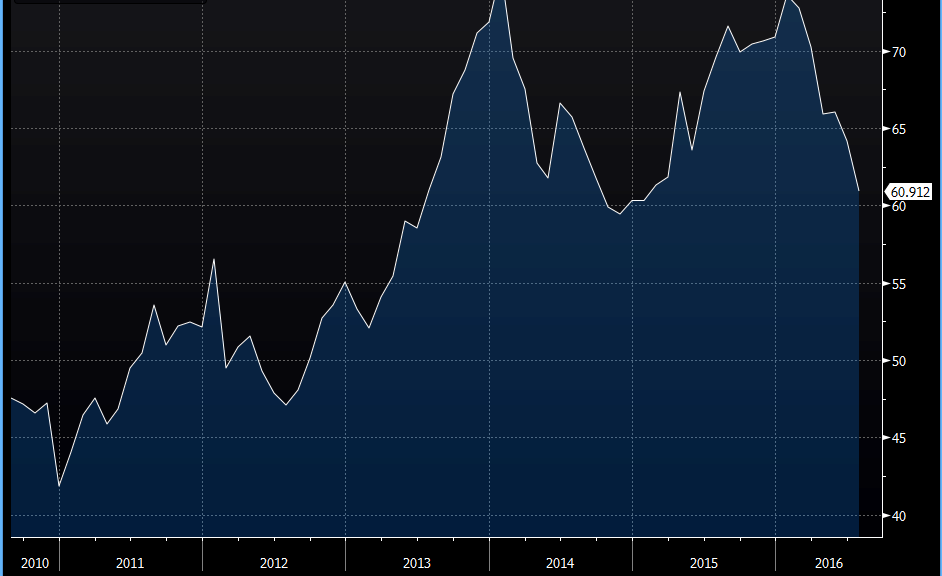

U.K. Mortgage Approvals Decline In July

Mortgage Approvals measures the number of new mortgages approved for home purchases during the previous month by the Bank of England.

Advertisement

The number of new mortgage approvals fell in July, suggesting a post-Brexit vote knock to the housing market.

Within consumer credit, credit card lending increased by £479 million in July, down from £579m in June. The data tends to have a limited impact because about 60% of all mortgages are covered by the BBA Mortgage Approvals data released a few days earlier.

This was the lowest since January 2015 and below what a majority of economists were predicting.

Lending secured on dwellings increased by GBP 2.7 billion in July, slower than a GBP 3.2 billion rise seen in June.

The Bank of England also reported that the net mortgage lending of 2.7 billion pounds was below expectations of 3.1 billion pounds, from previous 3.2 billion, and consumer credit was lower at 1.2 billion as well, compared with expectations of 1.7 billion and June’s 1.9 billion. “There is serious concern that businesses will rein back their activities, especially investment, due to heightened uncertainty in the aftermath of the Brexit vote [.] although much will also depend on the demand for loans”, Dr.

Mortgage loans are now almost 20% below the recent peak of 73,000 seen in February.

“On the one hand, this may make people more cautious over borrowing, but.it may increase the need for some people to borrow”.

The annual growth in M4 accelerated to 3.9 percent from 3.6 percent in June.

Advertisement

“Many household budgets have never really recovered from the financial crisis – and amid less certain economic times, we need to be prepared for an increase in debt problems in the United Kingdom in the years ahead”, she said.