-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

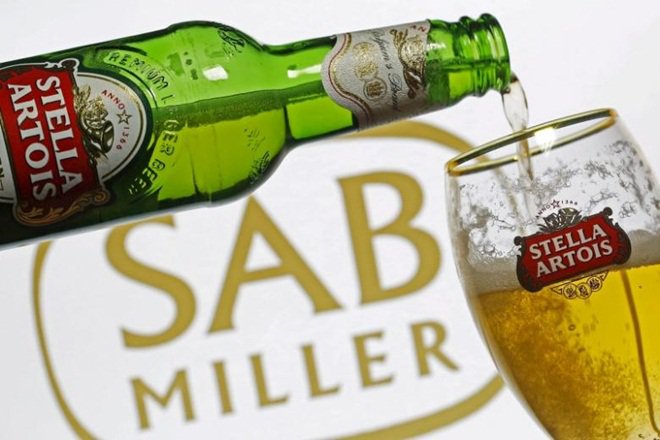

UK court sides with small shareholders on beer merger

LONDON-SABMiller PLC on Tuesday said a United Kingdom court had agreed to its proposal that its two largest shareholders be treated as a separate class from the rest of its investors with regard to its pending acquisition by Anheuser-Busch InBev NV.

Advertisement

SABMiller will now need at least 75 percent of other voting shareholders to give their assent, and its two largest holders, BevCo Ltd. and Altria Group Inc., will be considered separately. The largest two, which together control about 40 percent of the shares, have already signaled their support.

The split was ordered at SABMiller’s request after some investors expressed disquiet about a so-called partial share alternative designed as a tax-friendly option for Altria and BevCo, the holding company for Colombia’s Santo Domingo family.

A split would effectively raise the hurdle, since each class would have to approve the terms by three-quarters.

“I have jurisdiction to order a meeting of public shareholders to be summoned that does not include Altria and BevCo”, Snowden told the court.

The SABMiller board has recommended that shareholders accept the Belgian brewer’s all-cash offer of £45 a share, up from its earlier price of £44, valuing the London-listed firm at around £79 billion.

“It’s bad news in that it increases the risk compared to there only being one class of shareholders, but based on our calculations the chances of the deal still going through are high”, Gonzalez Lastra said by phone.

To head off protracted renegotiations, AB InBev sweetened its offer, which it declared “final”. “From the people that have been vocally against it, it’s hard to get anywhere close” to the number needed to stop the deal, he said.

AB InBev, the maker of Budweiser, Corona, and Stella Artois, is trying to buy SABMiller in a massive deal that would merge the world’s two largest beer makers.

The shareholder vote will be taken at a meeting on September 28, with trading in SABMiller shares scheduled to end on October 4.

Advertisement

SAB’s shares were down marginally at 4,375 pence at 1159 GMT while AB InBev’s stock was up 1 percent at 112.10 euros.