-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

US Dollar soars on hawkish Federal Reserve

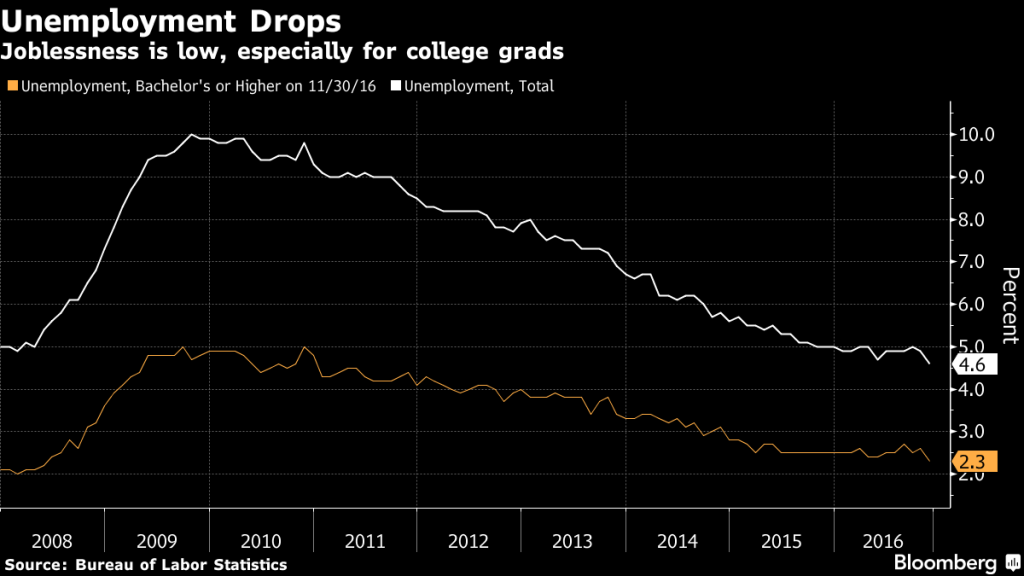

In last week’s decision to raise rates, Fed officials indicated that full employment is getting closer, with the jobless rate now at 4.6 percent.

Advertisement

Just before Yellen spoke to graduates, the Federal Reserve released a survey conducted in December 2015 that found that young people are increasingly optimistic about the future.

About 2.25 million net new jobs were created over the past 12 months. If the inflation rate were to stop inching towards 2% or if inflation expectations are lowered, the pace of rate hikes, if any, may be slowed. This effectively means that this member expects only one rate hike over the coming three years. Thirty-five year trends don’t change easily. Core inflation, which strips out volatile fuel and food, is at 1.7 percent – higher, but still not where the Fed wants it.

Among the sectors the industrial sector was down last Thursday by 1 211 points or 1.68 percent (2percent for the week), financials lost 717 points or 1.8 percent (2.1 percent), while the gold index tumbled 8.62 percent (3.8percent). For about a year, markets have discussed, debated and anticipated the impending rate hike. With the notable exception of China and Malaysia, foreign reserve levels and current account balances have improved since 2013, particularly in the case of Indonesia and India, focal points of investor nervousness three years ago. This was a unanimous decision, as the growing chorus of dissenters from previous meetings finally got the interest rate hike they were looking for. “The Fed overestimated what they thought the growth was going to be for 2016”. Further, what if the Fed’s importance as a central bank diminishes, “at least in the near term”? Despite this raft of data, markets will likely continue to overlook short-term focused monthly data releases in favour of the broader political and macroeconomic picture, with two rate hikes from the USA now fully priced in for next year. This is good news.

Bond yields are largely a function of inflation expectations. Although interest rates continued to rise last week, investors remained attracted to corporate bonds and corporate credit spreads continued to compress.

The Fed’s forecasts have been wide of the mark for years (it had previously forecast three hikes in 2016) but bond-market investors seem to be buying the Fed’s view more so now than they have over the past several years, and that has pushed US bond yields sharply higher.

Advertisement

The sharp rise in the dollar is occurring amid a significant drop in foreign purchases of local bonds in emerging Asian markets.