-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

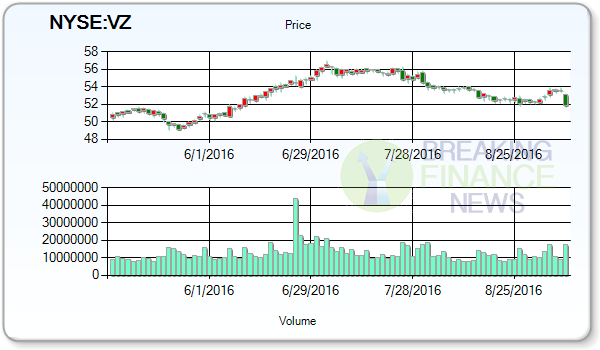

Verizon Communications Inc.’s (VZ)

(NYSE:LVLT) in a research note issued to investors on Monday morning.

Advertisement

Several executives took part in recent insider activity for the stock. The corporation has an earnings per share (EPS) ratio of 3.54. Level 3 Communications makes up approx 0.05% of Louisiana State Employees Retirement System’s portfolio. The bearish price estimate is $42 and the positive target is $60.

During last 3 month it remained at -1.57%.

At the current price Level 3 Communications, Inc. Macquarie reiterated a neutral rating and issued a $55.00 price target on shares of Verizon Communications in a research note on Wednesday, July 6th. Rating Scale; where 1.0 rating means Strong Buy, 2.0 rating signify Buy, 3.0 recommendation reveals Hold, 4.0 rating score shows Sell and 5.0 displays Strong Sell signal. The company has a consensus rating of Buy and a consensus price target of $61.47. (NYSE:LVLT) rose +2.5231% in trading session and finally closed at $49.5699. It points if stock price records a movement of over $-9.16, it will hit 52-week high. The corporation has a market capitalization of US$216.93 Billion. With the last stock price down 1.86% relative to the 200-day average, compared to the S&P 500 which has had no change over the same period. (NYSE:LVLT), according to U.S. Securities and Exchange Commission (SEC) filings.

Indeed, earnings growth is among the most important things to look in regards to stock investing and, accordingly, investors seek companies who have been successful at growing their earnings by at least 25 percent over a 3 year period. The business had revenue of $30.53 billion for the quarter, compared to analysts’ expectations of $30.95 billion. Verizon Communications had a return on equity of 87.41% and a net margin of 11.10%. The company’s revenue was up.9% compared to the same quarter past year. The reported earnings topped the analyst’s consensus by $0.01 with the surprise factor of 2.70%.

In related news, EVP John Michael Ryan sold 6,000 shares of the stock in a transaction on Thursday, September 1st. The stock was sold at an average price of $50.82, for a total transaction of $109,263.00. For the past 5 years, the company’s revenue has grown 2.4%, while the company’s earnings per share has grown 15.4%. Following the completion of the transaction, the senior vice president now directly owns 68,372 shares of the company’s stock, valued at approximately $3,474,665.04. The disclosure for this sale can be found here. Level 3 Communications was Downgraded by JP Morgan to ” Neutral” on Jul 28, 2016. Royal London Asset Management Ltd. now owns 103,440 shares of the company’s stock worth $5,608,000 after buying an additional 1,283 shares in the last quarter.

FDx Advisors Inc. raised its stake in Verizon Communications by 45.4% in the fourth quarter. The Company’s operating segments include North America includes operations in Georgia Colorado Florida Canada New York Arizona Pennsylvania Michigan and Oklahoma; Europe includes operations in England Ireland The Netherlands and France; The Latin America includes operations in Colombia Argentina Venezuela Peru Ecuador Chile and Brazil.

Advertisement

With that in mind Verizon Communications Inc. Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Level 3 Communications Inc. and related companies with our FREE daily email newsletter.