-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

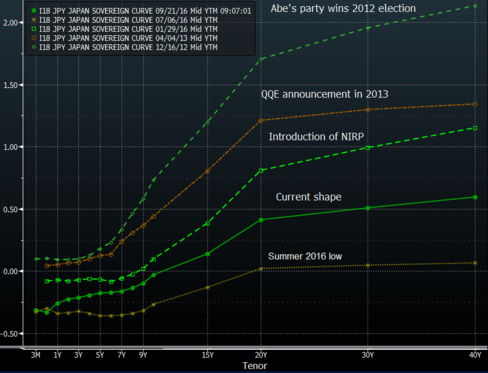

Wall St higher as tech, energy gain

The Dow Jones Industrial Average rose 50 points, or 0.3%, to 18,181 and the Nasdaq Composite Index reversed direction to add 23 points, or 0.4%, at 5,264. “The gist [of the policy change] is that ‘the Bank stands ready to conduct fixed-rate JGB purchase operations – for example, those with regard to 10-year and 20-year JGB yields – in order to prevent the yield curve from deviating substantially from the current levels'”. That’s sending dividend-paying stocks higher.

Advertisement

US crude futures jumped 2.5 percent to $45.12 a barrel, while Brent crude futures were up 1.8 percent at $46.72.

The BOJ also said it would not hesitate to ease monetary policy to support growth. Anadarko Petroleum shares rose $2.68, or 4.6%, to $60.98 while Chevron advanced $1.51, or 1.5%, to $99.21.

Fed in the spotlight: With most analysts not expecting a change in US interest rates, the talking point will be the Federal Open Market Committee’s accompanying statement.

The BoJ will continue applying a negative interest rate of -0.1 percent to the policy rate balances in current accounts held by financial institutions. Those steps could have weakened the yen. Brent crude, used to price global oils, rose 89 cents, or 1.9 percent, to $46.77 a barrel in London.

After the Fed decision, 10 of 11 major S&P sectors were in positive territory.

But that seemed at odds with both the overhaul of policy focus and the fact that the core consumer prices fell an annual 0.5 percent in July, the weakest reading since before the BOJ launched its stimulus program in 2013.

CarMax Inc.(KMX) shared slid 2.7% after the used auto seller reported disappointing fiscal second-quarter results.

Gold stocks have moved sharply higher on the day, driving the NYSE Arca Gold Bugs Index up by 3.4 percent.

“The moves on Wall Street today will be a function of moves in the 10-year Treasury yields and whether the USA dollar will stay steady after the “hawkish hold” by the Fed”, Quincy Krosby, said market strategist, at Prudential Financial.

CHECKS IN THE MAIL: FedEx boosted its forecasts for the year as it projected a record holiday season, and the shipping company posted better first-quarter results than analysts had expected.

The stock was also the top influence on the S&P 500 and the Nasdaq. Retailer Target said it plans to buy back $5 billion in company stock, and its shares rose 47 cents to $69.09. The euro dipped to $1.1151 from $1.1157.

Japanese stocks rose almost 2 percent after the move, which could ease profit pressure on banks and insurers from ultra-low interest rates, though analysts doubted the impact would trickle down much into the broader economy. Heating oil added 2 cents, or 1.7 per cent, to $1.43 a gallon.

Advertisement

Amgen fell 46 cents to $172.92 while Alexion Pharmaceuticals slid $2.10, or 1.6%, to $129.63. Financial stocks rallied in Tokyo (http://www.marketwatch.com/story/nikkei-climbs-led-by- financials-in-wake-of-bank-of-japan-announcement-2016-09-21), with the Nikkei 225 index closing up 1.9%. Silver gained 49 cents, or 2.5 per cent, to $19.77 an ounce. Australia’s S&P/ASX 200 gained 0.5 percent to 5,327.90 and South Korea’s Kospi was nearly flat, at 2,026.56.