-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

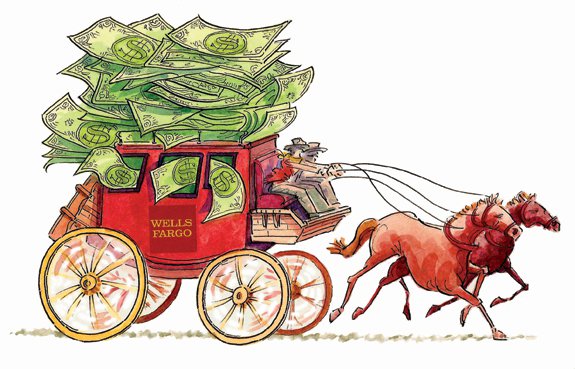

Wells Fargo Insurance Names Calvert Head of Client Experience in Colorado

And in March 2009, Citi’s price took a stomach-churning tumble to 97 cents a share, down more than 95 percent from the previous year. Wells Fargo is worth $301.6 billion. Equity analysts at the Brokerage firm Keefe Bruyette & Woods maintains its rating on Wells Fargo & Company (NYSE:WFC). The standard deviation of the price targets is $5.031.

Advertisement

“We notice that Wells Fargo continues to exhibit strong fundamental performance and has enjoyed a premium valuation multiple to its peers over the years”, she says. They now have a $55.00 price target on the stock, up previously from $54.00. 3 stock experts have also rated a buy.

But Wells Fargo stock still holds up as an investment with continued bright prospects.

7/6/2015 – Wells Fargo & Co. had its “outperform” rating reaffirmed by analysts at Credit Suisse. This is an important indicator as a higher ratio typically suggests that investors are expecting higher future earnings growth compared to companies in the same industry with lower price to earnings ratios. They now have a “market perform” rating on the stock. Post opening the session at $58.02, the shares hit an intraday low of $57.75 and an intraday high of $58.37 and the price vacillated in this range throughout the day. (NYSE:WFC) opened at 58.52 on Thursday.

“It’s certainly a nice recognition, but for us it’s pretty much heads down and keep your focus on your work”, Wells Fargo spokeswoman Mary Eshet says. The company has a market cap of $298,164 million and there are 5,145,200,000 shares in outstanding. (NYSE:WFC) last released its earnings data on Tuesday, July 14th. The consensus analyst estimates according to First Call for the next quarter is 1.05. That’s $40 billion more than J.P. Morgan Chase and nearly $120 more than Citigroup. The standard deviation before the number was posted was $0.04.

Advertisement

In the prior quarter, Wells Fargo & Company (NYSE:WFC) saw a surprise factor of -0.96%. The Insider selling transaction was disclosed on Jul 24, 2015 to the Securities and Exchange Commission. Also, EVP Kevin A. Rhein sold 17,500 shares of the company’s stock in a transaction dated Friday, May 8th. The disclosure for this sale can be found here. Wells Fargo & Company was ranked No. 30 on Fortune’s 2015 rankings of America’s largest corporations. Founded in 1852 and headquartered in San Francisco, Wells Fargo provides banking, insurance, investments, mortgage, and consumer and commercial finance through 8,700 locations, 12,800 ATMs, the internet (wellsfargo.com) and mobile banking, and has offices in 36 countries to support customers who conduct business in the global economy.