-

Tips for becoming a good boxer - November 6, 2020

-

7 expert tips for making your hens night a memorable one - November 6, 2020

-

5 reasons to host your Christmas party on a cruise boat - November 6, 2020

-

What to do when you’re charged with a crime - November 6, 2020

-

Should you get one or multiple dogs? Here’s all you need to know - November 3, 2020

-

A Guide: How to Build Your Very Own Magic Mirror - February 14, 2019

-

Our Top Inspirational Baseball Stars - November 24, 2018

-

Five Tech Tools That Will Help You Turn Your Blog into a Business - November 24, 2018

-

How to Indulge on Vacation without Expanding Your Waist - November 9, 2018

-

5 Strategies for Businesses to Appeal to Today’s Increasingly Mobile-Crazed Customers - November 9, 2018

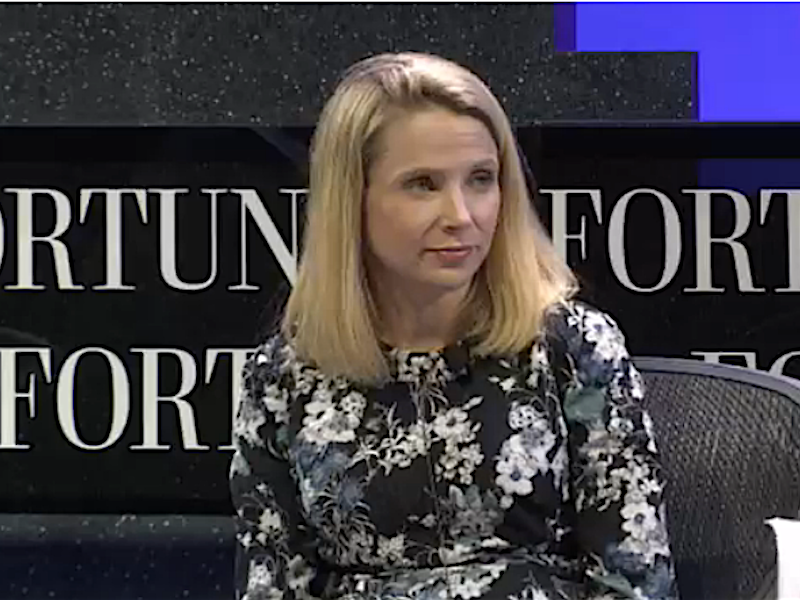

Yahoo Investor Wants Firm To Lay Off 9000 Staff

The company also said it did not plan to sell itself, and some long-disgruntled investors aren’t OK with that.

Advertisement

With sales hovering around 2006 levels, Sunnyvale, California-based Yahoo has been facing pressure from investors for a long time.

Investor groups strongly oppose giving Mayer more time to show progress on the turnaround, as they say her efforts have not shown any signs of progress so far.

Another Yahoo investor, NY hedge fund SpringOwl Asset Management, is proposing a new plan to slash the company’s workforce by 75%, replace Ms. Mayer with an operations-focused CEO and bring in a strategic partner to help Yahoo navigate the tax issues surrounding its Asian assets. The breakup is an alternate to another tax-dodging plan that Yahoo had been working on throughout this year: spinning off its $32 billion stake in China’s Alibaba Group into a new company called Aabaco. The Journal story said another fund, SpringOwl Asset Management, was also criticizing the Yahoo restructuring.

Mr. Jackson said he has sent Yahoo’s board a 99-page slide presentation which details a plan to turn around the struggling Internet business by slimming it down and focusing on a few areas where the company excels, such as its sports and finance sites.

Now the company is reportedly considering selling its core internet business, which includes Yahoo Mail.

A Yahoo spokeswoman declined to reveal the twins’ names or weights.

Yahoo CEO Marissa Mayer has followed a major business announcement with some big personal news.

SpringOwl’s sentiment contrasts with that of Starboard Value, the activist investor that prompted Yahoo to announce last week that it was pursuing a different course. He predicted that with cost-cutting and profitability improvements, the core businesses could even amount to at least $24 billion.

Advertisement

“We find it hard to comprehend that in the face of months of tax uncertainty regarding the spinoff there was apparently no ‘plan B,”‘ Canyon Capital wrote. “Requiring shareholders to continue to wait for definitive action for another year or more – and extending the tenure of senior management” is “simply unacceptable”. However, last week, Chairman Maynard Webb said the board has not approved a sale process but it has “a fiduciary duty to entertain any offers”.